The 85 upstream projects up for Final Investment Decisions (FIDs) in 2019 include 75 greenfield developments, with approximately 42 billion barrel of oil equivalent (Bboe) of resources and 10 expansion phases, according to GlobalData, a leading data and analytics company.

The company’s latest research reveals that natural gas projects contain 70% of the resources from greenfield developments awaiting approval in 2019, with Exxon Mobil leading the project count and forecast investment. As the oil price continued to recover in 2018, there was a significant uptick in FIDs sanctioned. Despite the oil price dip in the fourth quarter, many companies pressed ahead with major FIDs. Cost cutting and higher cash reserves from reduced investment over the past few years has led to the increase in FIDs and more optimistic outlook in the industry despite the volatile oil price.

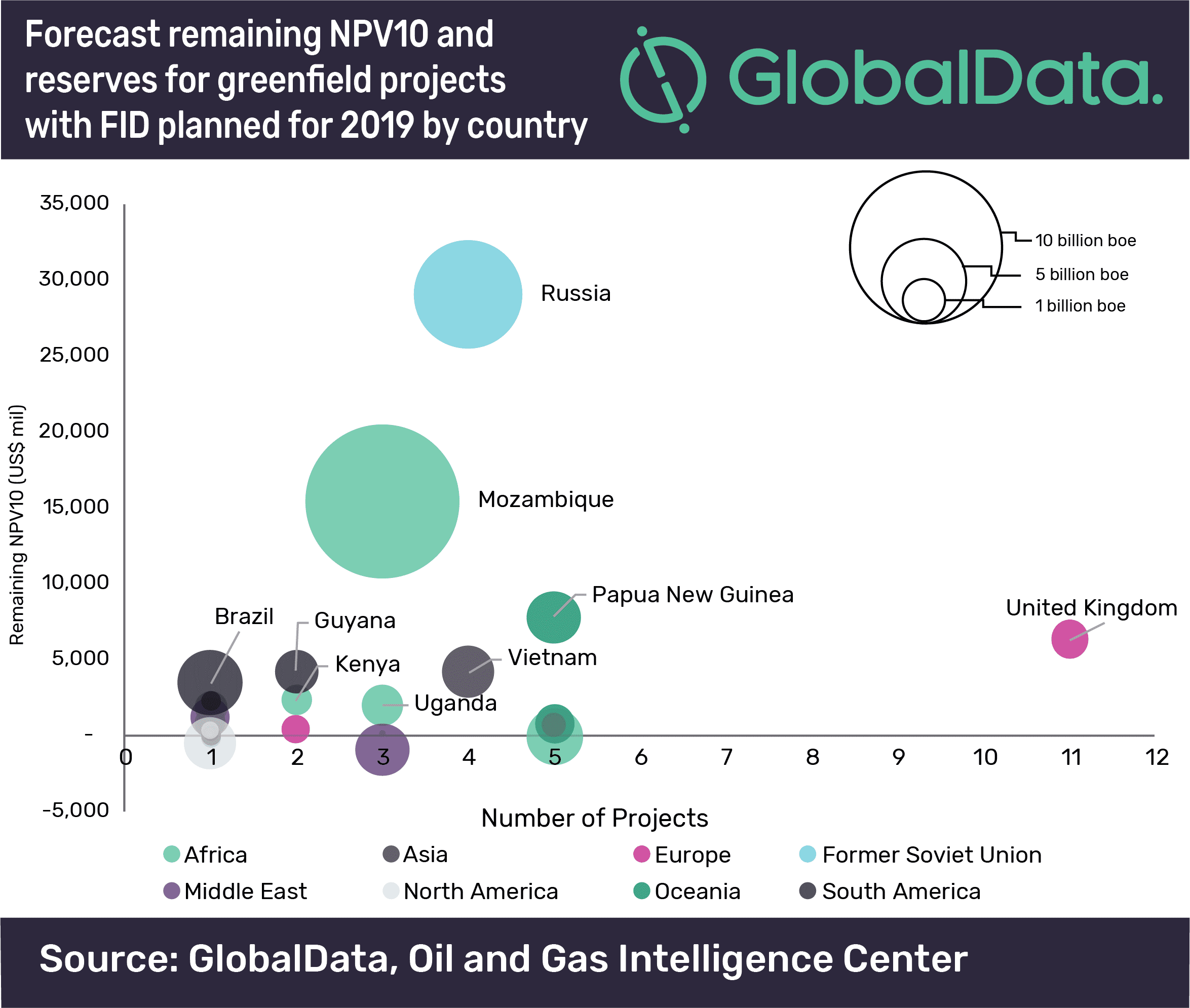

Jonathan Markham, Senior Oil and Gas Analyst at GlobalData, comments: “Russia and Mozambique have the largest projects with scheduled FIDs in 2019, ranked by recoverable resources. These are primarily gas megaprojects intended to supply LNG exports. This trend is reflected in other areas, particularly in the Asia-Pacific region, with major gas developments to feed LNG projects in Australia and Papua New Guinea, and for power demand in Vietnam.”

Certain oil field developments are still viable in the current price environment, but are either on the giant scale (500 mmboe+) or rely on nearby infrastructure to reduce the upfront capital expenditure (capex). The major oil projects are located in the Americas, including additional phases at the giant Libra pre-salt oil field in Brazil, the recent Liza discovery in Guyana and new developments that could revitalize Mexico’s upstream sector.

Markham adds: “Securing funding for these key FIDs is expected to be a major challenge given the oil price volatility and environmental concerns. Major integrated companies and government-backed organizations are expected to be the primary drivers behind the expenditure on new projects.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.