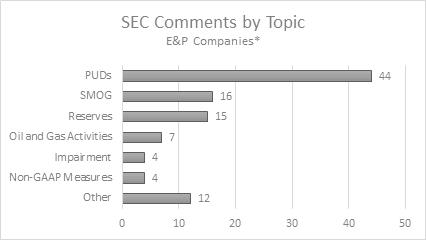

As we wind down 2018 and turn our attention toward year-end disclosures, it is helpful to review U.S Securities and Exchange Commission (SEC) comment letter trends to improve financial statement disclosures and identify potential deficiencies. As shown in the chart below, during the last 12 months, the SEC staff issued approximately 100 comments on disclosures made in Forms 10-K and 10-Q to 24 upstream companies. Here, we examine the most common comments received and offer suggestions for best practices for preparing year-end disclosures. We are often asked to assist our clients in drafting and reviewing footnote disclosures, as well as responding to SEC comments.

*Comments issued on Forms 10-K and 10-Q for SIC Code 1311 – Crude Petroleum & Natural Gas

during the period from September 1, 2017 through August 31, 2018.

Proved Undeveloped Reserves (PUDs)

It is not surprising that most SEC comments, approximately 45%, focused on PUDs, since they are a primary driver of an upstream company’s value. Most comments concerned PUD conversion rates. The SEC staff questions the legitimacy of PUDs when historical conversion rates do not appear to support future development of PUDs within the required five-year timeframe. The SEC staff also questioned unexplained differences in year-over-year planned versus actual results that indicate changes in or (perhaps) a lack of a formal development plan for PUDs.

Examples of SEC Comments

- You disclose that you converted 29.7 million barrels of oil equivalent (Mmboe) of proved undeveloped reserves to developed status during 2016, equating to approximately 11% of the total prior year-end proved undeveloped reserves. In comparison, you disclose 341 MMBoe in total proved undeveloped reserves to be converted to developed status over the next five years. Given that this rate of development, if sustained, would not be sufficient to develop your reserves over the next five years, disclose the reasons for the limited progress made during 2016 and explain whether, and to what extent and in what manner, your plans relating to the conversion of your remaining proved undeveloped reserves have changed to ensure that your reserve estimates adhere to the criteria in Rule 4-10(a)(31)(ii) of Regulation S-X. Please note, disclosure under Item 1203(c) of Regulation S-K should inform readers regarding progress, or lack thereof, and any factors that impacted progress in converting proved undeveloped reserves to developed status.

- Disclosure on page 5 of your Form 10-K for the fiscal year ended December 31, 2015 indicates that you planned to spend $746 million to develop your PUD reserves during 2016. Please reconcile this amount to the actual amount spent of $281 million. Additionally, given the large difference between planned and actual spending, explain to us, in reasonable detail, your basis for concluding that you had adopted a development plan with respect to your PUD volumes as of December 31, 2015. As part of your response, tell us, by area, the locations and volumes scheduled for development during 2016 according to the plan underlying your PUD volumes as of December 31, 2015 and explain how this compares to actual locations and volumes developed during 2016. Please note that the mere intent to develop, without more, does not constitute “adoption” of a development plan and therefore would not, in and of itself, justify recognition of reserves. See Compliance and Disclosure Interpretation 131.04.

Best Practices for PUD Disclosures

Calculate and analyze historical and future planned PUD conversion rates. Provide robust disclosure about any changes in planned versus actual results.

Support disclosures with detailed development plans showing PUD locations and volumes by area. Monitor progress and disclose reasons for any significant deviations from plan.

Remember that a commitment to a development plan should be specific and not based only on intentions. A final investment decision includes assessing the funding for such projects and should be approved by management.

Changes in Standardized Measure of Oil & Gas (SMOG)

Comments on disclosures of changes in SMOG primarily related to failure to adequately describe and categorize changes in reserve quantities as required by ASC 932-235-50-5.

Examples of SEC Comments

- Expand your explanation of the changes in the net quantities of proved reserves resulting from revisions of previous estimates to identify and quantify each factor that contributed to a change in reserves. To the extent that two or more unrelated factors are combined to arrive at the line item figure, your disclosure should separately identify and quantify each individual factor, including offsetting factors, so that the change in net reserves between periods is fully explained. The disclosure of revisions in the previous estimates of reserves in particular should identify such factors as changes caused by commodity prices, well performance, unsuccessful and/or uneconomic proved undeveloped locations or the removal of proved undeveloped locations due to changes in a previously adopted development plan. Refer to FASB ASC 932-235-50-5.

- We note the line item “Extensions, discoveries and other additions” in your presentation of changes in net quantities of proved reserves. Tell us the nature and amount of other additions for each of the three years presented.

Best Practices for Changes in SMOG Disclosures

Ensure disclosures of changes in reserve quantities include the categories listed in ASC 932-235-50-5 and drivers of each change are adequately described. Categories should not be aggregated.

For changes in reserves related to revisions, separately disclose any significant factors that contribute to the overall change, including positive and negative revisions that offset. The disclosure of revisions should identify such factors as changes caused by commodity prices, well performance, unsuccessful and/or uneconomic proved undeveloped locations or the removal of proved undeveloped locations due to changes in a previously adopted development plan.

Oil & Gas Activities

Comments related to oil and gas activities address deviations from the disclosure requirements of Item 1200 of Regulation S-K. The SEC staff issued comments to three registrants questioning whether disclosed “resource potential” met the definition of reserves. Another comment issued to multiple registrants related to failure to adequately disclose production by final product sold.

Examples of SEC Comments

- You disclose that the unrisked recoverable resource potential relating to the drilling inventory attributed to your prospects is “estimated to be 800 MMboe on a gross (100% working interest).” We note similar disclosure in your filing on Form 10-Q for the period ended December 31, 2017 along with a reference to your net working interest for the Canoe and Tau Prospects, which “could hold over 50 MMboe recoverable oil and gas.” The Instruction to Item 1202 of Regulation S-K generally prohibits disclosure in any document publicly filed with the Commission of the estimates and/or the values of oil or gas resources other than reserves. If your estimates do not fulfill the requirements to be classified as reserves under Rule 4-10(a) of Regulation S-X, please revise your filing in each occurrence to exclude such disclosure.

- Tell us how you considered the requirements with regard to disclosure of production, by final product sold, for each field that contains 15% or more of your total proved reserves. Refer to Item 1204(a) of Regulation S-K and Rule 4-10(a)(15) of Regulation S-X.

Best Practices for Disclosures of Oil & Gas Activities

Re-examine Item 1200 of Regulation S-K and consider if all disclosure requirements contained therein are met.

Impairment

In its comments on impairments, the SEC staff asked registrants to disclose in Management’s Discussion and Analysis (MD&A) risks and uncertainties associated with the recoverability of assets and requested that registrants inform them about methods and assumptions used in impairment tests.

Examples of SEC Comments

- Your response to prior comment 7 states that a deterioration in expected future prices for oil and NGLs caused you to perform an impairment analysis at June 30, 2017. Revise to provide additional disclosure discussing and analyzing the facts and circumstances surrounding known material trends and uncertainties related to future commodity prices and the implications to your financial statements. Refer to Item 303(a)(3) of Regulation S-K along with section III.B. of SEC Release No. 33-8350.

- Tell us the specific policies, procedures and methodologies you use to assess unevaluated properties for possible impairment. For the unevaluated property acquisition costs incurred prior to 2015, describe for us, in reasonable detail, the planned activities for these properties as of each of the years ended December 31, 2015, December 31, 2016 and December 31, 2017, as well as the quarter ended March 31, 2018. Explain the nature of and reasons for any changes in the planned activities between these dates. Additionally, describe the actual activities related to these properties during subsequent periods, and explain the reasons for any differences between planned and actual activities.

Non-GAAP Measures

For the last couple of years, non-GAAP measures have been a major focus area of the SEC staff across all industries. There is particular concern when those measures differ significantly from or are presented more prominently than GAAP metrics. Comments received by upstream registrants related to 1) omitting a reconciliation of the non-GAAP measure to the closest GAAP measure and 2) using titles for non-GAAP measures that are similar to those of GAAP measures.

Examples of SEC Comments

- We note from your response to prior comment 5 that you believe the title of Corporate Margin is not commonly used and is not a standardized measure and, therefore, would not be viewed as a substitute or confused with a GAAP measure. However, we believe that your presentation does not comply with Item 10(e)(1)(ii)(E) of Regulation S-K, which prohibits using titles for non-GAAP measures that are the same as, or confusingly similar to, titles or descriptions used for GAAP financial measures. Accordingly, please revise the title Corporate Margin to provide a more appropriate description of this measure.

- We note that current and/or forward-looking information is provided for Non-GAAP Free Cash Flow, Non-GAAP Corporate Margin, Return on Capital Employed (ROCE) and Net Debt to Adjusted EBITDA without reconciliation to the most directly comparable GAAP measure. Tell us how you considered Item 10(e)(1)(i)(B) of Regulation S-K and Question 102.10 of the Non-GAAP Compliance & Disclosure Interpretations.

Best Practices for Disclosures of Non-GAAP Measures

Ensure the most directly comparable GAAP financial measure is given equal or greater prominence than the non-GAAP measure.

Provide a reconciliation to the most directly comparable GAAP financial measure, starting with the GAAP measure.

Disclose the reasons why management believes the non-GAAP financial measure provides useful information to investors.

Other Topics

Twelve other SEC comments received relate to a range of topics, including commitments and contingencies, segments and major customer disclosures, among others. Because the filings reviewed within the sample period (September 1, 2017 to August 31, 2018) related to periods prior to the effective date of the new revenue recognition guidance in ASC Topic 606, “Revenue from contracts with customers”, there have been limited comments on the topic of revenue recognition; however, one registrant received the following comment:

You disclose on page 11 that in connection with your adoption, effective January 1, 2018, of ASC Topic 606 – Revenue from Contracts with Customers, you have determined, as of September 30, 2017, that the deferred gains recorded under the [Gathering and Processing Disposition] (as defined in Note 11 – Related Party Transactions) could be de-recognized under the new standard. Please provide us the analysis that you performed to support this determination, including the applicable ASC 606 paragraph references.

Here, the issue is that sales of certain equity method investments that formerly qualified as “in-substance real estate” under ASC 360-20, “Real estate sales”, will now be accounted for under ASC 860, “Transfers and servicing” (ASC 360-20 was superseded by ASC 606). If certain requirements are met, gains on sales that were previously deferred due to the continuing involvement provisions of ASC 360-20 may now be fully recognizable under ASC 860. Here is the registrant’s response to the SEC staff’s comment:

In response to the Staff’s comment, prior to the adoption of ASC 606, the sale of our membership interests in the [Gathering and Processing] equity method investments were accounted for under ASC 360-20 and deferred gains were recorded accordingly. As the deferred gains remain on the balance sheet, the contracts are “open” and are subject to potential changes in accounting treatment. In accordance with ASC 606-10-65-1 as it relates to ASC 860-10-15-4, following the adoption of ASC 606, sales of equity method investments will now be accounted for under ASC 860. While we are still in the process of deliberating and reaching a conclusion on the treatment of this transaction with our auditors, upon adoption of ASC 606, we expect the deferred gains to be de-recognized through an opening adjustment to retained earnings under the modified retrospective adoption approach. We anticipate reaching a final conclusion prior to filing the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 and will disclose as such in our related filing.

In their Annual Report on Form 10-K for the year ended December 31, 2017, this registrant disclosed that they would de-recognize the deferred gain on the sale upon the adoption of ASC 606. We are aware of at least one other upstream registrant that de-recognized a deferred gain related to the sale of an equity method investment in “in-substance real estate” upon adoption of ASC 606. The guidance in ASC 860 is challenging and particularly difficult to apply to oil and gas transactions; therefore, we recommend that companies consult with their auditors and advisors when applying this guidance. Depending on the facts and circumstances of the transaction, it may be advisable to preclear accounting for sales of equity method investments under ASC 860 with the SEC.

Amy Stutzman is a Managing Director in Opportune’s Complex Financial Reporting Group with eighteen years of experience in technical accounting and SEC reporting. Amy leads teams that support executive management in understanding the structure and implications of complex transactions such as IPOs and acquisitions. She has strong technical skills and analytical ability and is the firm leader on all U.S. GAAP advisory matters. Prior to joining Opportune, Amy managed the financial reporting group for Apache Corporation in Buenos Aires, Argentina, and was an audit manager in PricewaterhouseCoopers’ energy practice.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.