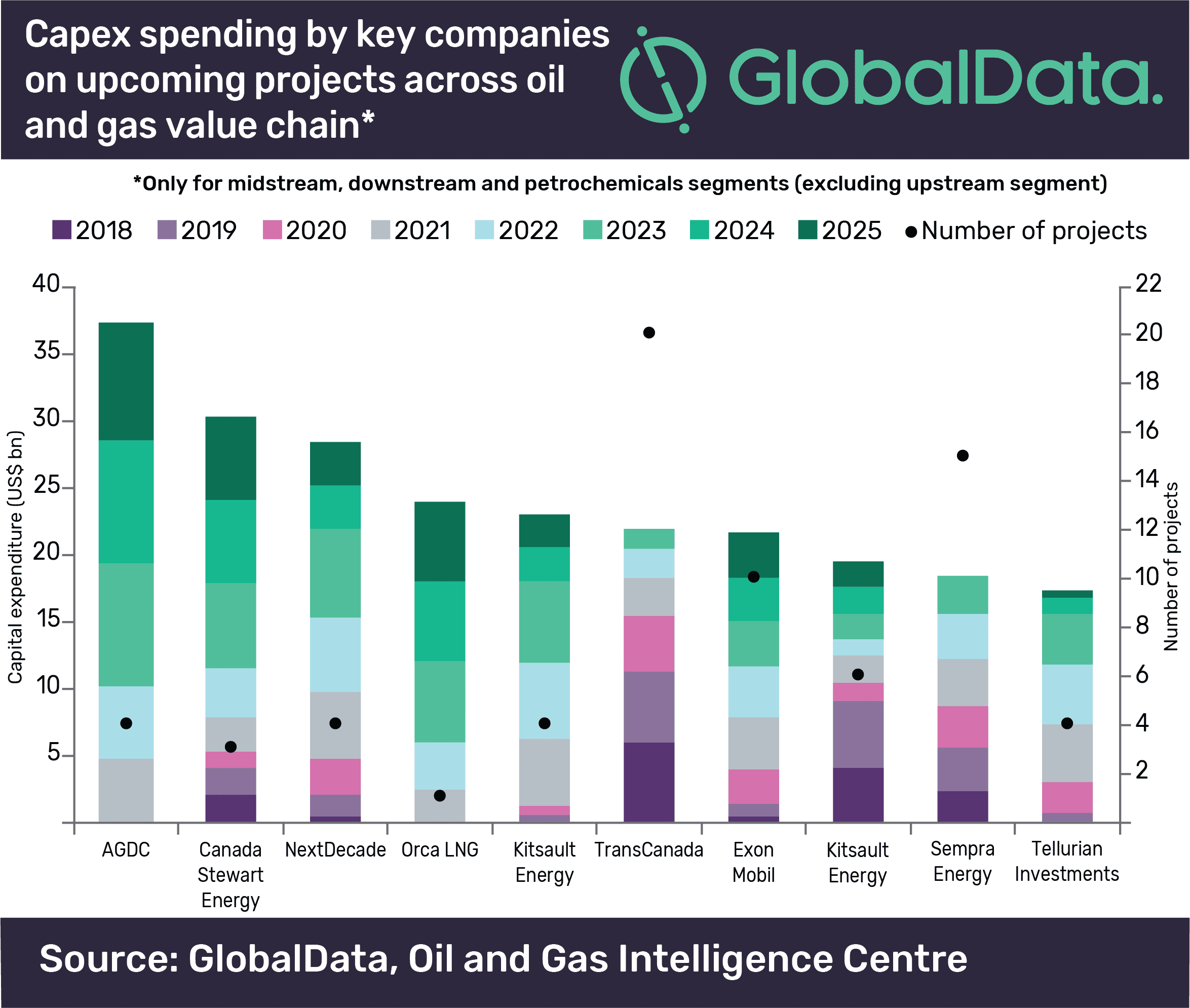

Alaska Gasline Development Corp is the top spender among all oil and gas companies in North America, in terms of new build capital expenditure (capex) to be spent during 2018–2025, on planned and announced projects across midstream and downstream segments (including petrochemicals), according to leading data and analytics company GlobalData.

The company’s report: ‘Top Oil and Gas Companies Capital Expenditure Outlook for Midstream and Downstream Segments in North America – Alaska Gasline Development Corp Leads Capex among Companies in Region’ reveals that AGDC tops the list with capex of US$37.3bn followed by Canada Stewart Energy and NextDecade Corp with capex of US$30.3bn and US$28.4bn, respectively.

Soorya Tejomoortula, Oil & Gas Analyst at GlobalData, comments: “AGDC has spread its new-build capex for the development of two natural gas pipelines, one LNG liquefaction terminal, and one gas processing plant. This will further aid the company’s objective of developing infrastructure to move natural gas to local and international markets.”

On the midstream side, AGDC is expected to lead gas processing segment in terms of new-build capex. The company is expected to spend US$5.9bn by 2025. In the LNG liquefaction front, Canada Stewart Energy is expected to spend US$28.8bn on two upcoming liquefaction terminals.

GlobalData identifies that TransCanada Corp leads both trunk pipelines and liquids storage segment with US$20.8bn and US$1.1bn by 2025, respectively. In the LNG regasification segment, Korea Gas Corp leads with US$1bn to be spent on an announced regasification terminal, by 2025. Magnum Gas Storage LLC leads the gas storage segment with estimated capex of US$0.35bn.

On the downstream side, Pacific Future Energy is expected to lead with estimated capex of US$14bn on the development of an announced refinery by 2023. Kitimat Clean Ltd and Pemex follow with capex of US$8.5bn and US$8.4bn, expected to be spent on one refinery each, during the period 2018–2025.

In the petrochemical sector, Formosa Plastics Group is expected to lead with estimated capex of US$8.3bn to be spent on nine upcoming petrochemical plants during the period 2018 to 2025, followed by Badlands NGLS LLC Plc with estimated capex of US$6.8bn and Royal Dutch Shell with US$5bn.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.