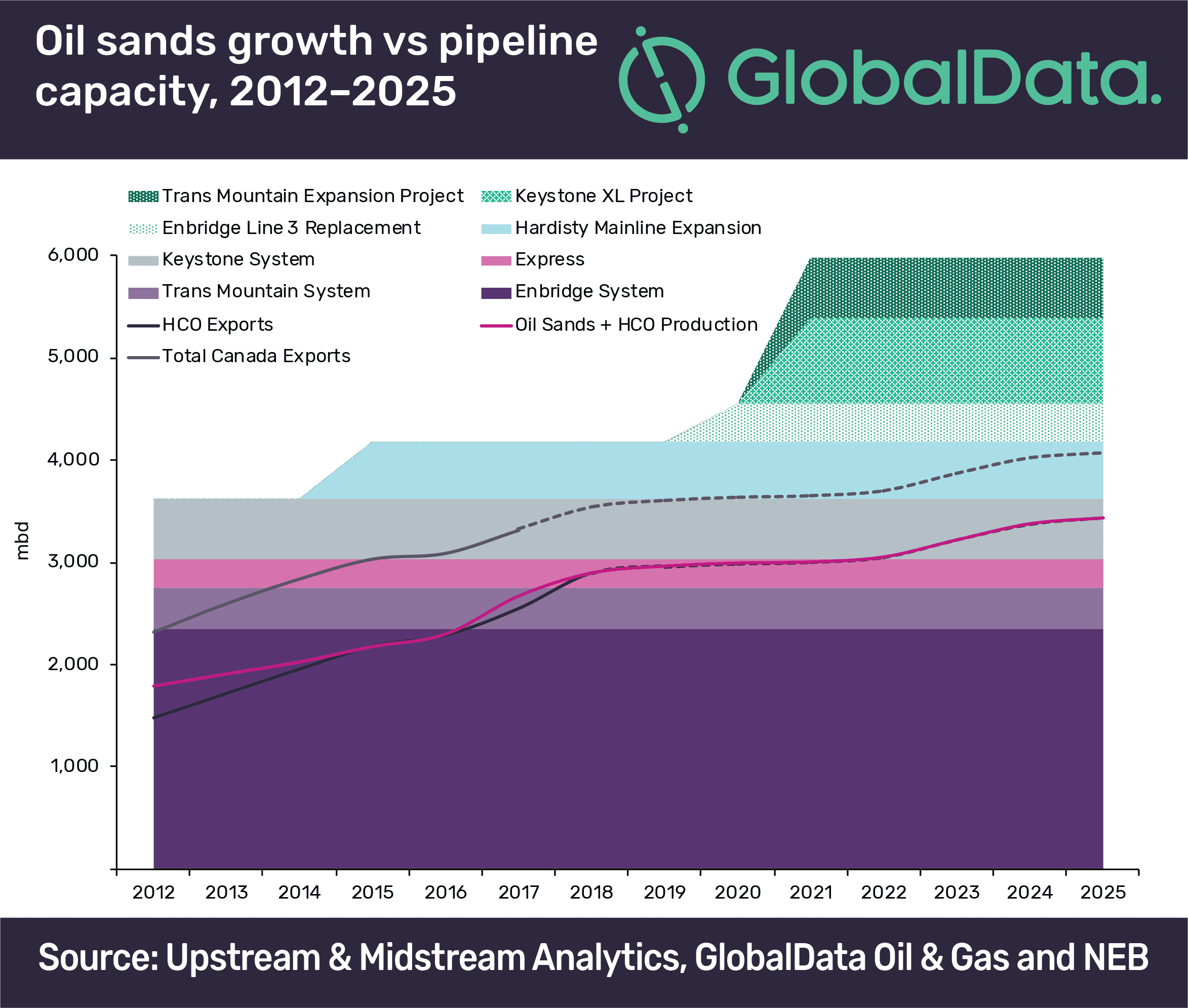

Canada’s existing oil pipeline and railway capacity is enough to support oil sands current exports but with little extra room for logistic constraints. Presently, there are at least three announced pipeline projects that will serve different markets and hence can support the diversification of exports and better pricing of oil sands production, says GlobalData, a leading data and analytics company.

The three announced pipeline projects are the Trans Mountain expansion project adding 590 thousand barrels per day (mbd) of capacity, the Enbridge Line 3 replacement adding 370 mbd of capacity and the Keystone XL project adding 830 mbd of capacity.

Adrian Lara, Oil & Gas Analyst at GlobalData, comments: “Once in operation the total pipeline capacity will be at a surplus even in a high case scenario for oil sands in which production surpasses 4 million barrels per day (mmbd) by 2025. This additional takeaway capacity will certainly provide the flexibility to minimize the pricing impact of any transportation bottlenecks.”

Since 2015 the volume of oil sands exports to the US Gulf Coast has been growing in average at approximately 100 mbd every year replacing Latin American exports of heavy crude grades. However the Canadian quality benchmark price for oil sands production, the West Canadian Select, still carries a larger discount when compared to the Maya crude grade that is also exported to the US Gulf Coast. Moving ahead with the 830 mbd Keystone XL pipeline will certainly establish a better price formation for the increasing oil sands demand in the gulf coast.

Lara adds: “Securing access to US refining markets is just the easiest plan in the shorter term and diversifying to Asian markets seems a reasonable longer term strategy. In spite of this strategic anticipation from both Canada’s government and oil sand operators, until the new pipeline capacity is built Alberta’s heavy crude oil production will remain subject to logistic constraints and relatively large price discounts.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.