Lower natural gas prices are causing E&P companies to get creative with their hedging strategies to lock in near-term cash flows above the dismal levels the market is currently offering. When hedging with options, it’s not uncommon for oil and gas producers to sell options and roll the premium value of the sold option into another hedging instrument.

An example of this is a costless collar. With a costless collar, a company buys a put option to establish a floor price they’ll receive for the sale of their commodity. Rather than pay the premium for buying the put option, the company sells a call option with an equal premium to offset the purchased put premium. The sold call option establishes a ceiling price they’ll receive for the sale of their commodity. The result allows a company to participate in commodity prices above the floor price and below the ceiling price.

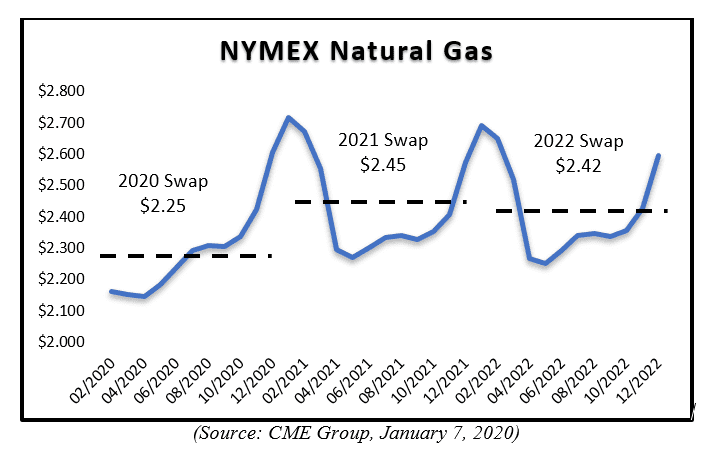

With calendar 2020 natural gas swap prices below $2.25/MMBtu, traditional swaps and costless collars aren’t appealing to many companies. This, combined with the fact that the NYMEX natural gas futures prices are in contango—where future prices are higher than the spot prices—has led some companies to sell options in future periods and roll the premium into near-term swaps. A strategy that’s gaining popularity is selling swaptions and rolling the premium into near-term swaps.

For example, let’s assume the current NYMEX swap prices are $2.25/MMBtu and $2.45/MMBtu for calendar years 2020 and 2021, respectively. Rather than hedge with swaps at these prices, a company may decide that it would rather sell an option giving the counterparty the right to enter into a swap for 2021 at $2.50/MMBtu (this is commonly referred to as a swaption as it’s the option to enter into a swap). When this option expires in December 2020 (or whichever expiry date is negotiated), if the swap price is above $2.50/MMBtu, the bank will execute their right to swap at $2.50/MMBtu, and if the prices are below $2.50/MMBtu, the bank will not.

A company is able to take the premium from selling the swaption and roll this value into a swap to get an above-market 2020 swap price. In this example, let’s assume the premium was $0.25/MMBtu, and the company would roll the $0.25/MMBtu premium into their 2020 swap to get an above-market swap price of $2.50/MMBtu, rather than $2.25/MMBtu. The downside is that the swaption doesn’t provide any price protection in 2021 if natural gas prices continue to go down and it limits upside potential if natural gas prices increase. However, it has become a viable alternative for many in this tough energy market.

Swaptions can create financial reporting complexities when it comes to determining the appropriate fair value to record in financial statements. Implied volatility inputs for NYMEX options are generally readily available. However, implied volatilities for swaptions are not. Determining appropriate volatility is calculation-intensive and requires consideration of various inputs.

The uniqueness of these trades often leads to a significant amount of attention from auditors, the need for valuation specialists and generally requires additional financial statement disclosures. Opportune’s professionals offer the unique understanding of hedging and financial reporting processes that allow us to add value to clients and meet their fair value reporting needs.

Matt Smith is a Director in Opportune’s financial instruments group. Matt assists companies with their accounting for complex financial instruments under both U.S. GAAP and IFRS. With 15 years of client service experience at Opportune and EY, Matt has gained extensive knowledge and expertise in derivative valuation and hedge accounting, stock-based compensation, debt and equity financing activities, embedded derivative assessments, Dodd-Frank compliance and SEC reporting. Matt has an undergraduate degree in Accounting from Oral Roberts University. He is also a member of the American Institute of Certified Public Accountants.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.