The recent events in Iraq – the attacks on a U.S. embassy, a U.S. drone strike that killed an Iranian general and Iran’s missile attack on a U.S. air base in Iraq – has created renewed tension in the Middle East with crude oil again taking center stage. West Texas Intermediate (WTI) crude prices spiked to a three-month high of nearly $66 per barrel (/bbl) after Iran launched missile strikes on U.S. military bases in Iraq in retaliation for the killing of commander Qassem Soleimani. WTI crude prices have since erased gains amid optimism of de-escalation efforts, holding steady at about $60/bbl.

Pending further hostilities between the U.S. and Iran, or other geopolitical events around the world, it’s not outside the realm of possibility that WTI crude prices could hit $70/bbl based on the below three factors:

- Political Risk: Overwhelming political risk with the U.S. and Iranian tension drove WTI crude prices to a fresh three-month high of $65.65/bbl. With no resolution in sight, uncertainty will remain the primary catalyst. Based on the market’s reaction to the September Iranian attack on Saudi’s assets vs. the recent U.S. Embassy attack, price uncertainty has become more digestible with diminishing price escalation as we approach $70/bbl. The ever-increasing U.S. sanctions may continue to escalate tensions and draw a more severe Iranian retaliation, forcing prices up to this expected level.

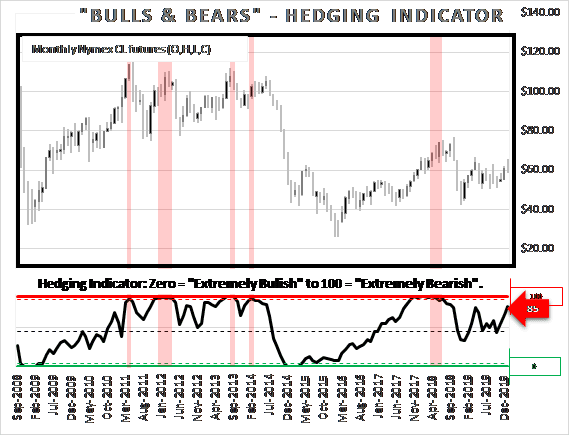

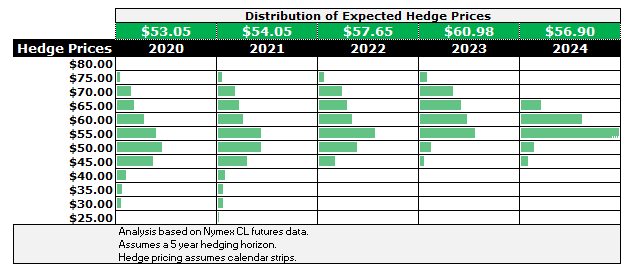

- Hedge Prices: The futures market is quietly indicating this risk is only temporary. While WTI prices have increased nearly 30% since August, expected hedge prices have barely increased by 5%. This disparity in pricing is not uncommon. In fact, we often see an extreme separation between these two, just prior to a significant downturn in the crude oil market. With current hedge prices remaining fairly constant, my analysis indicates that we need a minimum WTI price of $70/bbl to qualify as this extreme condition.

- Technicals: With minimal changes to my long-term fundamental outlook, slowing demand and strong growth in U.S. supply will continue to dominate for the foreseeable future. From a technical perspective, both long- and short-term indicators are also pointing to heavy resistance around $70/bbl. Long-term trend resistance starting in 2008, most recently tested in 2018, continues to be the ceiling for prices. Further, several short-term retracements have also overlapped around the $70/bbl mark.

If my calculations are correct and the $70/bbl level does hold, I see little relief from a pending lower price environment. While the remainder of 2020 should get a slight reprieve, 2021 and beyond may have already seen its best prices for the next several years.

(Source: Ryan Dusek, Director CMRA)

I continue to recommend that our clients hedge “sooner rather than later” and for as long of a tenor as possible. My focus is to offer each client a set of unique strategies that helps create options for their portfolio. With potentially lower prices on the horizon, we have been very proactive and offer many alternative approaches to minimizing risk.

Ryan is a Director at Opportune LLP. His industry experience includes commodity trading, risk management, supply chain optimization and derivative valuation. He is an expert in developing financial models to quantify complex/uncertain issues and deliver real-world solutions. He has extensive experience in the pricing, hedging and portfolio management of the retail natural gas markets. Ryan has led all aspects of commercial-deal structuring and pricing for wholesale natural gas trading and origination. He has over 15 years of experience in the energy industry. Ryan has an MBA from the University of Texas in San Antonio where he specialized in Finance.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.