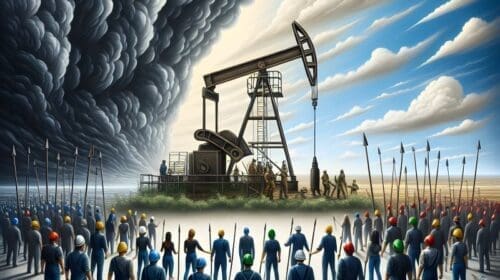

Data from a variety of sources indicate the cycle of contraction in the oil and gas industry has reversed and demand for petroleum products is returning.

The International Energy Agency (IEA) and the Energy Information Administration (EIA) at the U.S. Energy Department both released their short-termed forecasts stating economic activity is on the rise in the U.S. and globally, and they expect increases throughout 2021.

The oil and gas industry in Texas is responding with an increase in activity, according to the Texas Petro Index (TPI).

Activity in the oil patch has made gains since the historic lows witnessed last year. Employment, active drilling rigs, and commodity prices all have increased. However, not every indicator shows strength. Production has not recovered and drilling permits are down, too.

The TPI registered its first monthly increase in two years this month at 138.8.

Petroleum economist Karr Ingham, author of the TPI, said rigs have been added each month since the record lows in August.

Texas direct upstream oil and gas industry employment has increased about 7,400 since September, Ingham, who also serves as Executive Vice President of the Texas Alliance of Energy Producers, said. However, employment in the upstream Texas oil patch is at its lowest point since 2006, with total employment at some 154,000.

“The recovery from the COVID economy of 2020 is well underway and has been for several months even though the Texas Petro Index remained in decline,” Ingham said. “Frankly, that would likely still be the case for another month or two had Winter Storm Uri not wreaked havoc in natural gas markets in February, pushing the natural gas price sharply higher and taking the TPI up with it.”

Physical delivery gas prices across Texas escalated as demand rose. Houston Ship Channel price peaked at $400 per million British thermal units on Feb. 17 and averaged $36.93 for the month of February. The Waha hub in West Texas peaked at $205 on Feb. 17 and averaged $24.28 during the month.

The rise in the natural gas component of the TPI was a key reason for the monthly increase in the TPI, Ingham said.

Natural gas price at Houston Ship Channel closed at $2.75 per mmBtu on April 27 and at $2.51 at Waha.

Crude oil closed at $61 on NYMEX on April 27

U.S. gasoline price averaged $2.889 per gallon compared to $2.578 in Texas on April 27.

Alex Mills is the former President of the Texas Alliance of Energy Producers.

Alex Mills is the former President of the Texas Alliance of Energy Producers. The Alliance is the largest state oil and gas associations in the nation with more than 3,000 members in 305 cities and 28 states.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.