As private equity fund managers assess the economic impact of COVID-19, developing reliable valuation processes and procedures for their investments will ensure transparency to regulators and investors.

The valuation of private equity and venture capital investments has recently garnered greater marketplace attention. Prior to the coronavirus (COVID-19) pandemic, investors had been demanding more transparency and information than ever before. The impact of COVID-19 on the financial markets is sure to lead to even greater calls for transparency and enhanced information going forward as recent market volatility continues.

Meanwhile, the U.S. Securities and Exchange Commission (SEC) and independent auditors are more closely scrutinizing private equity valuation processes and procedures. The International Private Equity and Venture Capital Valuation (IPEV) Board released guidelines in 2012 and an update in 2015 to set out best practice recommendations around valuation that are intended to conform to IFRS and U.S. GAAP standards. The American Institute of Certified Public Accountants (AICPA) in 2018 issued draft guidance outlining best practices for preparing and documenting valuations of investments held by private equity and venture capital companies. In April 2020, the SEC announced that it voted to propose a new rule that would establish a framework for fund valuation practices.

Clearly, we’ve seen greater levels of scrutiny from an increasingly cautious investor base, along with best practices recommendations from IPEV, the AICPA and the SEC. All of this means that energy-focused private equity fund managers should develop processes and procedures to perform fair value analyses in support of their energy-related investments that are based on supportable market participant-derived assumptions. Developing a robust process will allow for a seamless review by their independent auditor and ensure that the funds’ financial statements comply with GAAP guidance.

Greater Private Equity Valuation Scrutiny

Recent years have seen greater private equity valuation scrutiny, including from the following regulatory and investor groups:

- SEC: In the years leading up to the recent COVID-19 pandemic, the SEC has more closely scrutinized private equity valuation processes and procedures. Marc Wyatt, Acting Director of the SEC Office of Compliance Inspections and Examinations noted in a May 2015 speech that valuation was one of several areas receiving heightened focus among SEC examiners in their review of private equity advisors. In May 2017, Jina L. Choi and Michele Wein Layne, directors of the SEC’s San Francisco and Los Angeles Regional Offices, respectively, noted in a securities enforcement forum that private equity managers and advisors should expect that valuation practices will continue to be an SEC exam and enforcement priority.

More recently, in April 2020, the SEC proposed a new rule focused on fund valuation practices. The rule, if adopted, would be applicable to all registered investment companies and business development companies, and would supersede valuation rules that haven’t been updated since 1970. SEC Chairman Jay Clayton stated, “[The] proposal would improve valuation practices, including oversight, thereby protecting investors and improving market efficiency, integrity and fairness.” The new rule highlights that “to determine the fair value of fund investments in good faith requires a certain minimum, consistent framework for fair value and standard of baseline practices across funds.” The SEC states that “in addition to providing requirements for estimating fair value in good faith, the proposed rule is designed to provide boards and advisers with a consistent, modern approach, to the allocation of fair value functions” while maintaining the oversight role and statutory duty boards are expected to fulfill. Boards are required to manage and oversee risks in the valuation process and ensure proper documentation of valuation conclusions, but they can use qualified experienced resources, including third-party valuation support, to exercise their “good faith” duties.

The proposed rule aligns with the requirements of Financial Accounting Standards Board Accounting Standards Codification Topic 820, Fair Value Measurements and Disclosures (ASC 820), and with Public Company Accounting Oversight Board (PCAOB) audit standards, which require greater scrutiny when fair value is determined using pricing services or broker quotes.

- IPEV: Additionally, the IPEV Board released guidelines in 2012, with an update in 2015, that set forth best practice recommendations around valuation that are intended to conform to IFRS and U.S. GAAP standards. These U.S. and international accounting standards were amended in 2011, resulting in a common international definition of fair value.

- AICPA: In 2018, the AICPA issued draft guidance around the valuation of portfolio companies held by alternative investment companies. This guidance seeks to help investment companies address the challenges around estimating and documenting their fair value measurements of these investments.

- Fund Limited Partners: Private equity fund limited partners are also more heavily reviewing valuation processes and procedures. Limited partners are increasingly scrutinizing the valuation inputs and assumptions presented by the general partners, both during their due diligence when analyzing new fund commitments, and their ongoing monitoring of existing investment performance. This limited partner scrutiny is certain to increase with market volatility brought about by COVID-19.

Recent Energy Market Volatility

In addition to increasing private equity valuation scrutiny, recent economic conditions have led to a new set of challenges. While most segments of the economy have been hit hard by the recent impact of COVID-19, the energy industry has been hit even harder thus far in 2020. The energy supply-demand balance has been upended as a result of the confluence of two events:

- A sharp reduction in demand related to stay-at-home restrictions put on states and cities across the U.S. and around the world resulting from COVID-19; and

- An unprecedented increase in supply resulting from tensions in the oil and gas markets between Russia and Saudi Arabia.

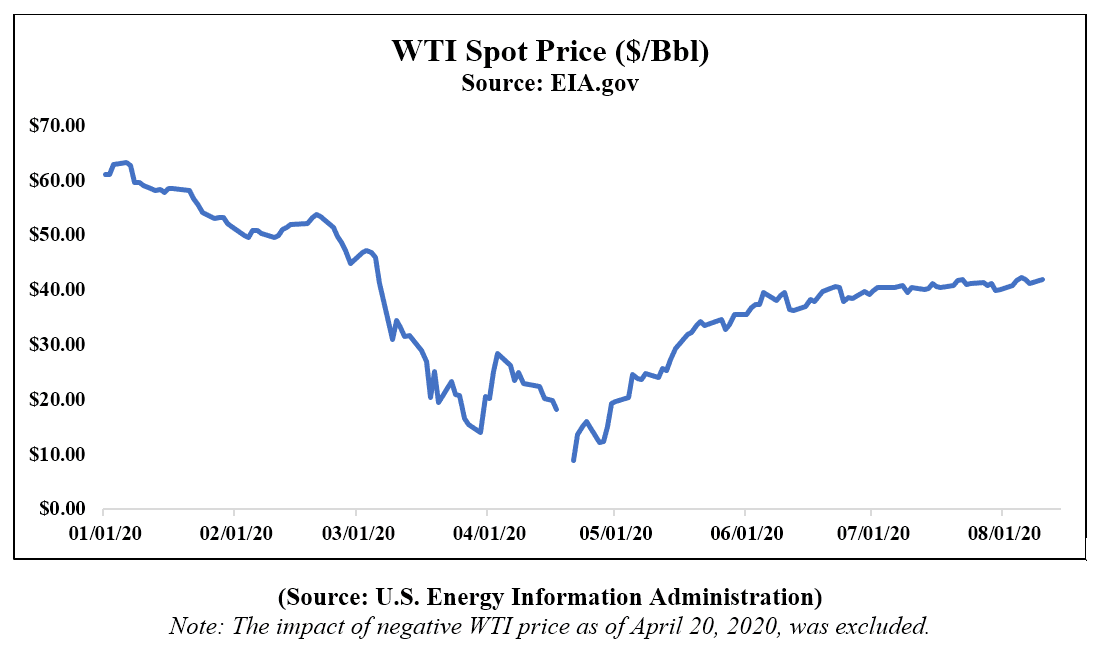

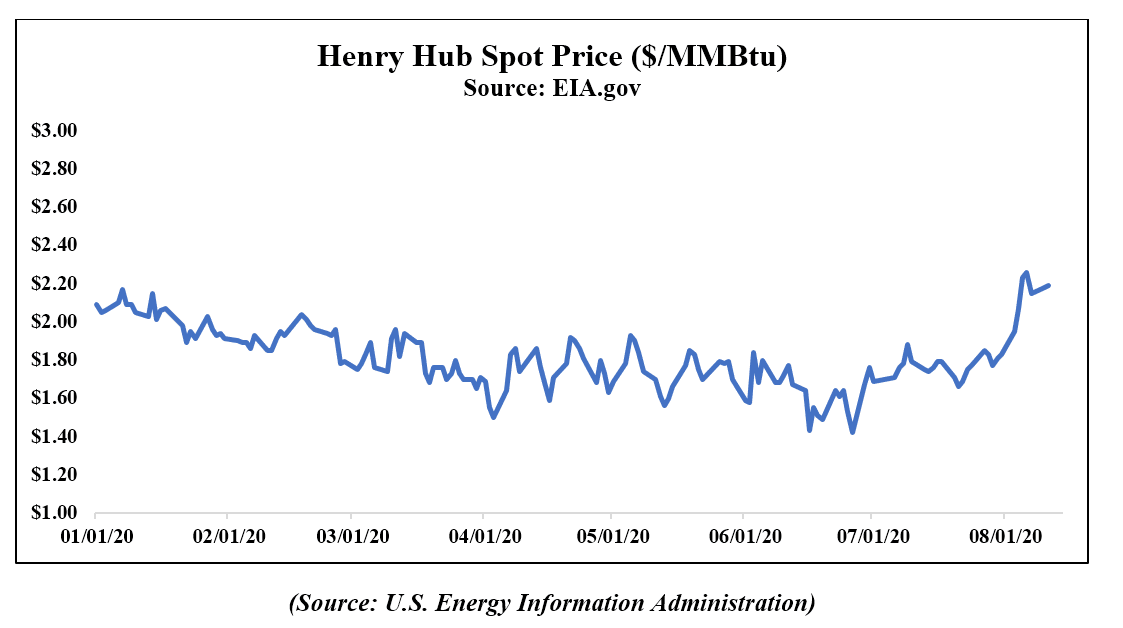

Between January 1 and April 30, 2020, the West Texas Intermediate (WTI) spot price for oil declined by nearly 70%; the Henry Hub spot price for natural gas was down by nearly 10%. From April 30 to August 15, 2020, the WTI spot price more than doubled, from approximately $19/bbl to $42/bbl; the Henry Hub spot price increased by 12% during that same timeframe. With oil prices in particular, there’s been a tremendous amount of volatility thus far in 2020, which may have a detrimental impact on the appetite for energy-related investments from the private equity market.

Valuation-Based Matters Commonly Encountered in Audits

Valuation-Based Matters Commonly Encountered in Audits

Private equity valuations have already received greater attention among regulators, investors and auditors. Now, with these factors, plus an uncertain economy, private equity fund managers who deal with upstream oil and gas investments should be familiar with valuation matters that are likely to be a focus of audit and regulatory review. Within the framework of mark-to-market accounting, private equity funds are required to report their investments on their GAAP financial statements at fair value. ASC 820 specifies that fair value is not an entity-specific value; rather, it’s a market participant-based measurement. As such, fund managers should ensure that their valuation analyses and procedures adhere to market participant-based assumptions.

In practice, the following are examples of matters that are commonly encountered in independent audit reviews of private equity valuations in the upstream oil and gas sector. We also discuss some of these matters against the backdrop of COVID-19 effects and how these matters may be addressed. This list isn’t exhaustive; however, private equity fund managers should be ready to address these items, and discuss them with their auditors, before and during an independent audit:

- Commodity Pricing: Internally prepared price decks, or price decks based on analyst pricing, are often utilized, which may represent a company-specific view. For financial reporting purposes, independent auditors may expect to instead see commodity pricing based on publicly available sources that reflect market participant assumptions, such as the NYMEX strip, or a forward-looking price deck based on independent analysts’ estimates. This is especially true in a volatile market environment, such as the one we’re currently seeing with the impacts of COVID-19 and Russia-Saudi tensions, where it may become more difficult to support the use of analyst forecasts on an unadjusted basis. During the current environment, special attention and consideration needs to be paid to the commodity price forecast that’s being used in developing fair value conclusions.

- Production Forecasts: Forecasting production in the current market environment is extremely challenging. Currently, there may not be enough production data available given the rise of COVID-19 in the U.S. and the precipitous decline of the financial and energy commodity markets that has occurred during Q1 and Q2 of this year. Further, another challenge for some companies, especially non-operators, is the lag they may experience in receiving recent production data. Compounding the amount and timing of available production data to forecast future production is recent production curtailments, recent shut-in production coming back online, and allocations from regulators.

- Risking Adjustments: Internally developed risking estimates by reserve category are often utilized in private equity valuations. However, independent auditors may expect to see risking that conforms to market participant standards, and that reflects the inherent risk of producing the hydrocarbons for the reserve category being valued.

- Income Taxes: The assumption of whether to apply corporate level income taxes in a discounted cash flow analysis of reserves should be based on a market participant view, and may depend on the following factors, among others: (1) the asset profile of the company in question; and (2) the profile of other companies involved in acquisition activity within the same area.

- Discount Rate: Independent auditors expect to see a discount rate based on a market participant-based weighted average cost of capital calculation. The income tax assumption should be consistent between the discount rate calculation and the discounted cash flow analysis (as discussed above). Estimating discount rates in the current economic environment can also pose a challenge. The risk-free rate has decreased, volatility has increased and debt-to-equity ratios are skewed higher. Simply going through the motions of calculating a weighted average cost of capital may erroneously result in a lower discount rate in the current environment than a discount rate calculated a couple of months prior. Given the increased uncertainty with cash flow projections, there’s more risk and the discount rate should be higher than discount rates pre-COVID-19. As such, extra care and consideration must be given to the inputs for a discount rate calculation in the current environment.

- Trading Multiples Utilized: Such multiples (for example, enterprise value-to-daily production or enterprise value-to-EBITDA) should be obtained either from applicable guideline transactions or guideline publicly traded companies. The selection criteria for comparable transactions and companies, as well as the rationale for any adjustments to multiples, should be documented. Multiples should also be recent enough to consider the current economic environment as of the valuation date.

- Exclusion of Certain Asset Classes: In some instances, undeveloped reserves are excluded from a company’s fair value analysis. However, this might not necessarily be reflective of a market participant view. For example, there may be upside value in proven undeveloped reserves (PUDs) and unproven reserves, even in the current commodity price environment, that a particular company might not recognize. However, such value may be recognized by a market participant.

Private equity managers should also be familiar with Accounting Standards Update (ASU) 2011-04, which describes requirements for disclosures around fair value measurements. Related to ASU 2011-04, auditors commonly look for the following information:

- Descriptions of valuation methods and key assumptions utilized, including inputs for Level 2 and Level 3 measurements (as defined under ASC 820);

- Quantitative information about significant unobservable inputs used for Level 3 measurements, as well as sensitivity analyses around these unobservable inputs; and

- Descriptions of valuation processes utilized.

These information requirements typically call for greater levels of documentation, which results in more private equity firms reviewing their internal processes and controls. These requirements, along with the commonly encountered valuation-related audit review matters noted above, have also led some firms to hire third-party advisors to assist in preparing their valuation analyses.

The preparation of a thorough, market participant-based valuation analysis may require greater up-front cost and effort. However, it will almost certainly lead to a smoother audit process and more transparency to regulators and investors as financial managers assess the economic impact of the COVID-19 pandemic.

Paul Legoudes is a Managing Director within the Valuation practice of Opportune LLP with over 18 years of experience serving companies in a variety of industries. He specializes in assisting clients with complex valuation needs and provides valuation services for financial reporting, tax, restructuring and consulting services in various industries, including oil and gas, industrial manufacturing, retail and consumer products. Paul has an MBA from the University of Texas at Austin where he specialized in Finance. Paul is a CFA Charterholder and is CPA-licensed in the State of Texas.

Kevin Cannon is a Principal in Opportune’s Valuation practice based in Houston. He has 19 years of experience performing business and asset valuations and providing corporate finance consulting. His specific experience includes valuations of businesses and intangible assets for purchase price allocations, impairment, tax planning, management planning and portfolio valuation purposes for companies in a variety of industries, including oil and gas, oilfield services, and industrial manufacturing.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.