Could Bitcoin mining be the solution to the oil and gas sector’s natural gas flaring dilemma?

The oil and gas industry is under continuing pressure to address issues related to natural gas flaring. The challenge is how to avoid reducing emissions in ways that would make smaller rigs unviable. Surprisingly, the solution could lie in Bitcoin mining.

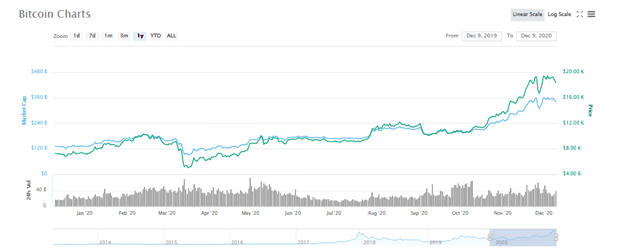

Bitcoin has more than doubled in price this year. The Bloomberg Galaxy Crypto Index has risen by over 190% this year. These price movements dwarf even the biggest increases in major commodities like silver (up 35% YTD), gold (up 21% YTD), and natural gas (up 15% YTD). There is also increasing interest on the part of banks and institutions in cryptocurrencies.

According to a recent Fidelity study, a growing number of institutional investors believe that digital assets should be included in their portfolios. And millions of retail investors have flooded into the market, which is easier to access than ever.

This doesn’t change the fact that Bitcoin and other cryptocurrencies are highly volatile. But what if you could convert unused natural gas, on site, into electricity that mines digital assets?

What Is Natural Gas Flaring and Why Do Oil Companies Care?

The oil and gas industry has begun taking steps to tackle Scope 3 greenhouse gas (GHG) emissions in recent years. However Scope 3 emissions are not entirely under the control of oil and gas companies, and so reducing them is complex and difficult.

In order to make an immediate impact, many companies have begun looking at Scope 1 emissions. The bulk of these emissions are related to the flaring and venting of associated gas.

The majority of oil production sites produce associated gases as a byproduct of the production process. For safety and economic reasons, these gases are typically either burned off via flaring or vented directly into the atmosphere.

While neither option is necessarily good for the environment, venting gas into the atmosphere is much worse. When natural gas is vented it is primarily methane (CH4), which is around 25 times more impactful a greenhouse gas than CO2 over a 100-year timespan. This means it makes much more environmental sense to flare or otherwise use the natural gas (converting it into CO2 instead).

While emissions vary from site to site, in some cases natural gas flaring or venting can contribute up to 90% of a particular site’s GHG emissions.

Natural Gas Prices Are Plummeting

Natural gas production is growing rapidly and the market is already experiencing oversupply. This, coupled with reduced economic output due to COVID-19, has led to natural gas prices trending negative. This makes it economically impractical for many oil fields to process or store natural gas, which encourages venting and flaring.

This problem is exacerbated by the infrastructure necessary to process natural gas in the first place. If companies are able to connect their field to a pipeline it is possible to sell their natural gas for non-fuel purposes, such as plastics production. But many oil fields have no access to the pipeline networks.

This, coupled with poor economic incentives, means that for many sites the only option is to vent or flare gas. It also means that any potential solution needs to be able to be deployed on-site, and not require expensive infrastructure.

Bitcoin Mining Operations Could Make Natural Gas Processing Profitable

Somewhat strangely, the solution to the gas flaring challenge could be Bitcoin and other proof of Work (PoW)-powered cryptocurrencies. PoW is a consensus method that Bitcoin uses in order to process transactions.

When a user wants to buy or sell Bitcoin, their transactions are placed on a block together with a handful of other transactions. Large networks of specialized computers, called ASICs, then have to solve a complicated puzzle in order to process that block, and the transactions within it. The successful computer is then rewarded with some cryptocurrency for its efforts.

Bitcoin mining is energy intensive. In 2019, the BBC reported that global Bitcoin mining was using more energy than the entire nation of Switzerland. This figure has increased in 2020 and it is estimated that the Bitcoin network is consuming almost 80 terawatt-hours per year.

The cost of electricity is a very important factor in making a mining operation successful. And natural gas converted into electricity and utilized on-site would essentially be free.

(Chart via Coinmarketcap.com)

(Chart via Coinmarketcap.com)

In light of Bitcoin’s explosive growth over the past year, this could represent a significant opportunity for oil producers to diversify while meeting decarbonization goals. Such a solution could help producers open up a new revenue stream from their operations and it could act as a hedge against uncertain oil and gas prices in the short to medium term.

Bringing Bitcoin Mining Operations to Oil Fields

Bitcoin mining in an oil field isn’t a pipe dream; it’s already being done. Denver-based Crusoe Energy Systems Inc. has already deployed it’s low-cost/no-cost “Digital Flare Mitigation” program to around 20 data centers in oil fields in the United States. The company also recently signed an agreement with Kraken Oil & Gas to deploy 18 more.

Crusoe Energy delivers its portable and modular systems to be used on site. They handle logistics and operations via a service agreement and at no upfront cost to operators. These portable systems are up in running in a few days.

Crusoe’s solution is designed to eliminate the need for flaring as well as venting. The company uses EPA-certified emission control technology and catalytic converters to significantly reduce emissions compared to flare exhaust streams. For example, they estimate that it can reduce methane emissions by up to 95%.

This solution has proven popular and a number of other companies are looking into using Crusoe Energy’s natural gas-powered Bitcoin mining as a decarbonization solution and alternative revenue stream.

The Norwegian state-owned oil company Equinor has announced a partnership with Crusoe Energy Solutions to use its unique solution to reduce flaring. Bitcoin mining company EZ Blockchain has also looked into how it can leverage unused gas in its own mining operations.

How Could This Process Change In The Future?

Bitcoin mining using natural gas is already a new idea, but as it becomes more established we will doubtless see more innovation in this process. The most obvious form of innovation will likely be to bring in more varieties of ASIC computers to mine other cryptocurrencies. This will enable companies to diversify their crypto assets and hedge against any sudden changes in the cryptocurrency market.

Another way that oil and gas companies could maximize their revenue is by capitalizing on DeFi developments. Advances like WBTC will enable companies to “stake” crypto projects based on Bitcoin or Ethereum. This will allow them to gain interest from, or invest in, promising cryptocurrency projects.

This will provide oil and gas company shareholders with exposure to one of the fastest growing asset classes in the world, and could be a major differentiator for smaller operators with rich natural gas production.

Environmentally Friendly Changes Need to Make Economic Sense

Part of the reason gas flaring continues to cast a shadow over the industry is economic viability. If an oil production project is not in a position to make a profit with associated gas release, the operators have little choice but to flare or vent. Punitive government measures might help in the short-term. But this risks a significant adverse effect on small to medium oil producers who may be unable to afford to comply.

Marrying cryptocurrency mining operations with natural gas energy is a simple and elegant solution to a regulatory problem and provides a new revenue stream. As more efficient, less polluting, uses for natural gas on-site become accessible, it is likely we will see a significant dip in 1st stage GHG emissions across the board.

Bitcoin mining represents an easy win for many oil companies who can then give themselves more breathing room to navigate uncertainty in the markets and plan for future actions on Scope 3 emissions.

Note: year-to-date prices for silver, gold, and natural gas cited are based on The Wall St. Journal’s tracking of the continuous front-month futures contract, as accessed on December 9, 2020.

Headline image: Pixabay

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.