Geopolitical and monetary policies have a massive impact on the oil and gas industry, as each shift can lead to major changes in growth projections, operational efficiency, and broader cost reduction strategies. Following Russia’s invasion of Ukraine in 2022 and the subsequent increase in commodity prices, a new wave of M&A activity has greatly impacted growth strategies in the oil and gas market.

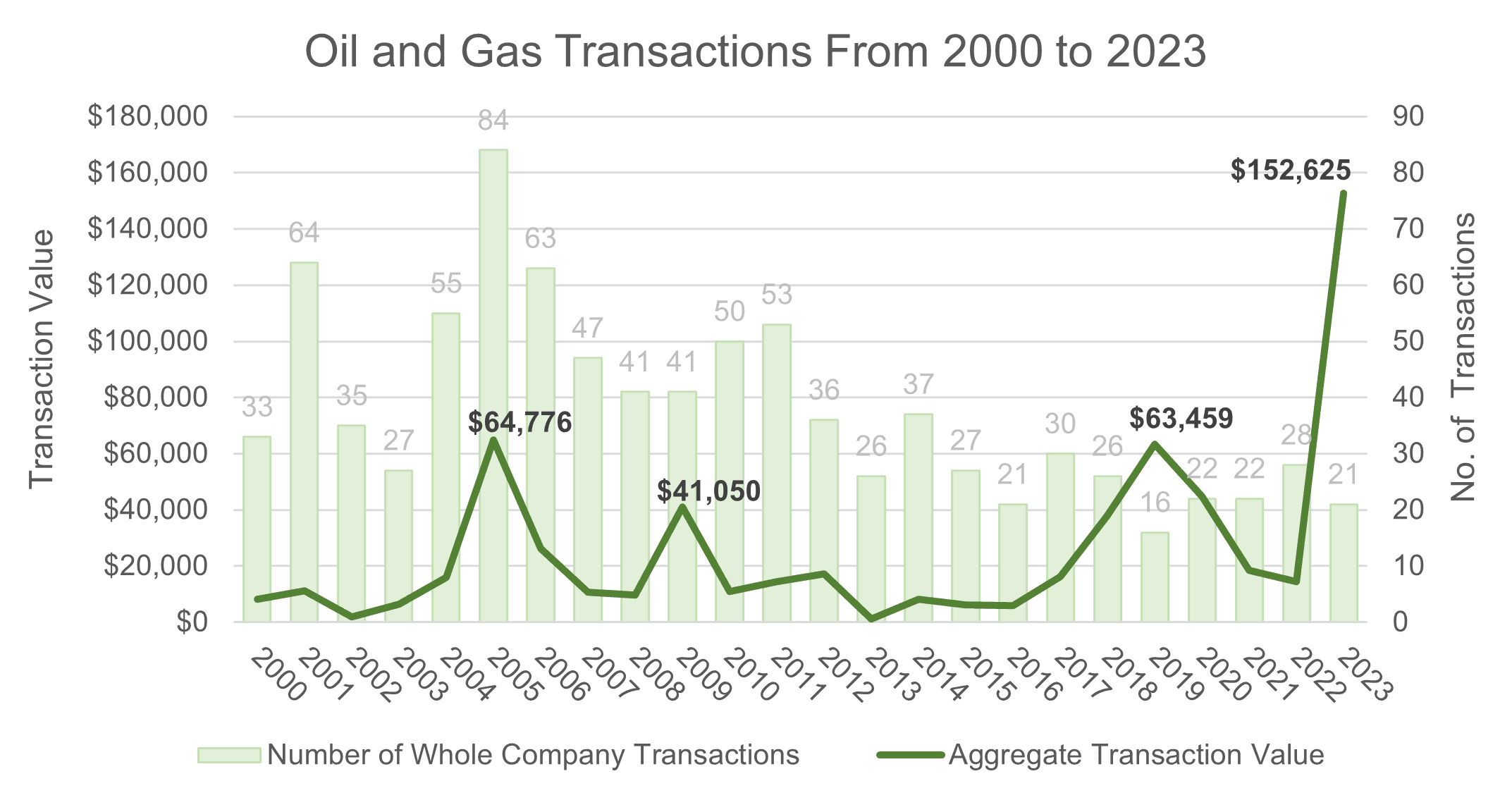

While M&A within the industry can certainly exhibit cyclical patterns, these business combinations are also influenced by broader economic trends, regulations, and strategic considerations specific to the industry. Regardless of the factors, there is no faster way to scale and eliminate competition than through M&A transactions. The chart below highlights the number of whole company transactions and aggregate transaction value on an annualized basis over the last twenty years:

Based on data from S&P Capital IQ

The data shows an uptick in the number of transactions in 2022 which continued into 2023, precipitated largely in part by global geopolitical instability. While 2023 saw fewer transactions compared to 2022 in volume, the aggregate transaction value was higher. This fits within the historic trend of consolidation: as the number of major oil and gas players continues to decline, average transaction values will likely grow.

So, are we through another major M&A wave? No, in fact, 2024 is shaping up to be a continuation of 2023, although transaction values are not expected to exceed 2023’s record year. It is likely that consolidation via merger will continue as oil and gas companies look to acquire a greater market share, streamline operations, and cut costs, all of which will have a significant impact to human capital structures and companies’ ability to attract, retain and motivate top tier talent in the oil and gas industry.

M&A’s Impact on Human Capital. M&A is not the only element creating retention and attraction issues within the energy space, and it is worth noting that economic downturns and commodity price volatility that have plagued the industry for decades are equally, if not more, influential when it comes to job security. Regardless, creative total rewards strategies are a necessity to minimizing talent loss and maintaining employee morale as oil and gas companies navigate shake-ups within the industry.

In M&A scenarios in the energy sector, acquiring companies will begin their due diligence process at the start of the transaction to better understand the target company. This usually includes a thorough review of the target company’s human capital structure, roles, compensation and benefits programs and more. If the transaction is successful, there will inevitably be parity between roles at the target and acquiring entities resulting in alignment among employee ranks and an elimination of ”haves and have nots”. Undertaking a comprehensive compensation and benefits assessment will help to identify gaps between similar roles at each entity. From an HR lens, it is important for the acquiring company to consider both financial and non-financial incentives to ensure employees are retained and stay engaged both during and after the deal closes.

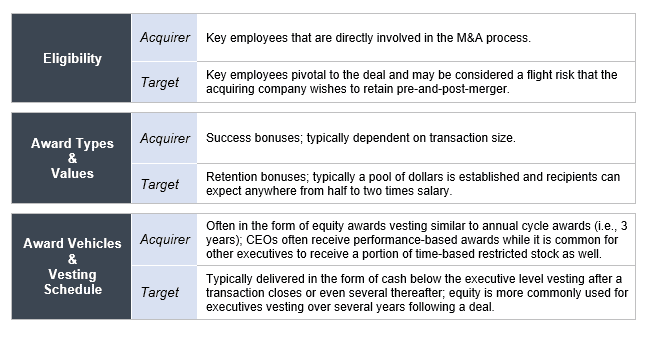

Financial Incentives During M&A. The use of retention bonuses is a common way for companies to keep people engaged after the transaction. These types of financial rewards are typically granted to key employees at the targeted company vesting over time.

On the acquiring side, it is common to see one-time awards, such as a “success bonuses”. These special awards are reserved for key personnel (executive and non-executive) that have had a hand in the M&A process, which may come in the form of cash, equity, or a combination of the two and can often be tied to performance metrics measuring the success of the transaction.

Such awards are typically provided where annual or long-term incentive program may not include, measure, or capture a planned transaction as a strategic objective, and where employee contributions and additional work required go above and beyond normal time and effort.

The following table highlights common financial incentives for both the target company and acquirer.

*Source: NFP commentary and data

*Source: NFP commentary and data

Non-financial Incentives Following M&A. As merging entities work to synchronize their total rewards programs, it is becoming more common for companies to take a hybrid approach by retaining the best non-compensation plan features as opposed to simply rolling under the acquirer’s programs, especially in large transactions. And in today’s environment, companies are looking to go beyond traditional compensation elements by identifying non-financial incentives that align with employee desires.

The selection and development of non-financial incentive programs under a merger or acquisition should be synergistically aligned with the mission and long-term strategy of the combined business. Further, given the various roles within a business, these incentives can look different depending upon where an employee is positioned within the company’s organization structure.

Career path initiatives, mentorship and employee training programs, flextime and PTO, special project opportunities, and even praise and recognition from leadership are a few of the most prevalent perks employees are seeking today. For example, some oil and gas companies are looking for new strategies to meet sustainability goals and are exploring options to upskill employees to help meet these targets benefiting both company and employees alike. With any employee engagement strategy, it is important to note that companies that not only tell their employees they are valued, but show them, experience long-term employee retention and engagement while simultaneously creating an attractive corporate culture.

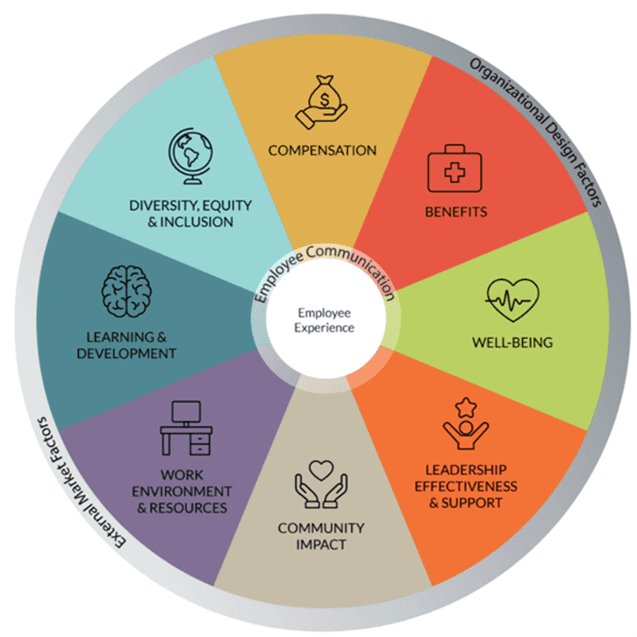

Total Rewards Approach. As part of any transaction, total rewards should be viewed as an integrated part of the employee experience. Total Rewards can be modeled through NFP’s Total Rewards Halo™ (see graphic below), knowing that different components of HR and Total Rewards will be more or less important at various stages throughout a company’s journey. It’s critical to understand what employees value and desire so companies can design meaningful and competitive programs that last. For example, well-being programs are receiving a lot of attention in the broader energy space, where some oil and gas employees can often be isolated in remote areas and might value expanded mental health benefits.

*Source NFP

*Source NFP

At the end of the day these programs should be creative enough to build an environment where employees feel confident and energized in their job and have the support they need to grow along with the business. As the oil and gas industry is likely to see the continued prevalence of M&A transactions in the coming years, keeping a pulse on this during major company reorganizations is essential for creating a memorable employee experience that enhances a company’s brand.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.