Austin, TX – May 8, 2018 – Drillinginfo, the leading energy SaaS and data analytics company, has taken a deep dive into the most prolific oil and gas basin the in the United States, the Permian Basin. With records indicating its first well was drilled in the 1920s, production of hydrocarbons in the Permian basin is not new, however, a revival of activity in recent years underscores the oil and gas industry’s focus on unconventional resources.

Every month, production from the Permian continues to set record highs even though the number of total active rigs remains below historical levels. In the latest installment of its FundamentalEdge series, Drillinginfo analysts reveal which U.S. operators continue to produce higher volumes of oil, natural gas and NGLs despite relatively weak prices and fewer active rigs. The question on everyone’s mind remains, how long will this last?

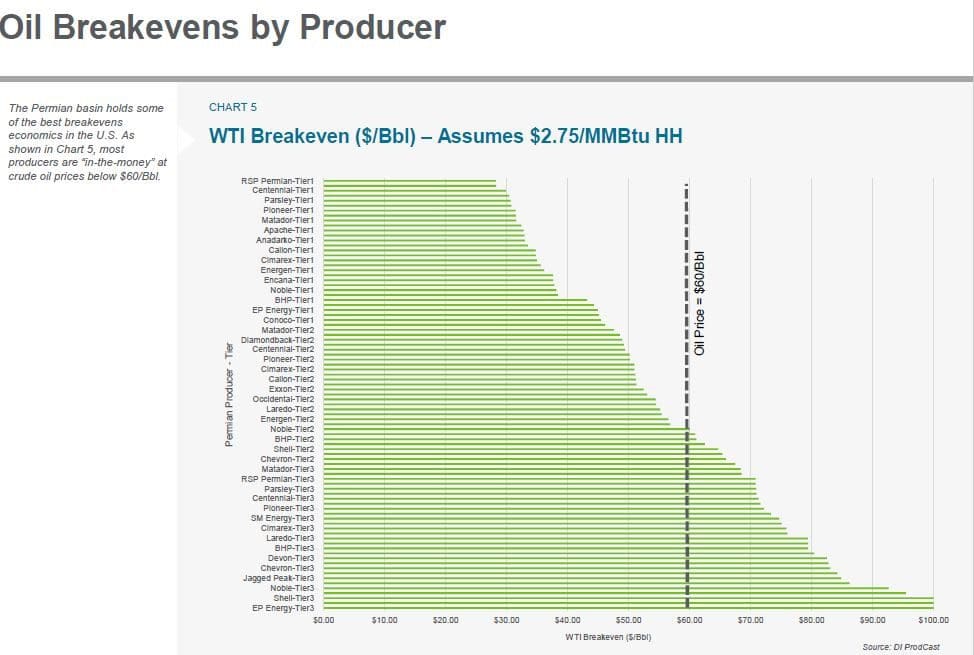

“There’s no doubt the oil and gas industry has hit its bottom and bounced back with the Permian basin leading the way,” said Bernadette Johnson, Vice President of Market Intelligence at Drillinginfo. “The Permian holds some of the best breakeven economics in the U.S., but not all leases and holdings are created equal. We’ve taken a look at all the companies operating here and ranked them by output and breakeven prices showcasing which operators are ‘in-the-money’ in today’s current price environment, as well as who can weather further price storms – and just as importantly, who cannot,” added Johnson.

“We also see takeaway capacity nearing its limits in the Permian and constraints could have consequences for some,” continued Johnson. “Some will thrive while others will barely survive,” said Johnson.

Johnson’s analysis and the key findings of Drillinginfo’s latest report come from DI ProdCast, Drillinginfo’s proprietary platform that performs in-depth market fundamental analysis with custom inputs to instantly gain actionable intelligence.

Key Takeaways from Drillinginfo’s FundamentalEdge report, The Permian Basin:

- Over the past five years, output from the Permian basin has doubled. Strong production growth is expected to continue due to favorable economics and Drillinginfo expects an additional 50% increase in oil and gas production over the next five years.

- The total rig count remains about 13% below the 2014 high, but the horizontal rig count reaches new highs every week leading the production gains.

- Over 30% of all US fracs in 2017 were located in the Permian. A shift in frac strategy is increasing the use of certain chemicals changing the way new wells are being completed across the basin.

- Infrastructure additions are falling behind production growth in the basin pushing price basis to historical lows. Many projects have been announced that will help alleviate this constraint in the mid to longer term.

- The financials review of key E&P operators in the basin shows CAPEX has increased by 20% in the past year supporting the upcoming production gains in the Permian.

- Drillinginfo DPR, first introduced in the January edition of this service, shows steep production growth in the short term (next three months) for the Permian basin.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.