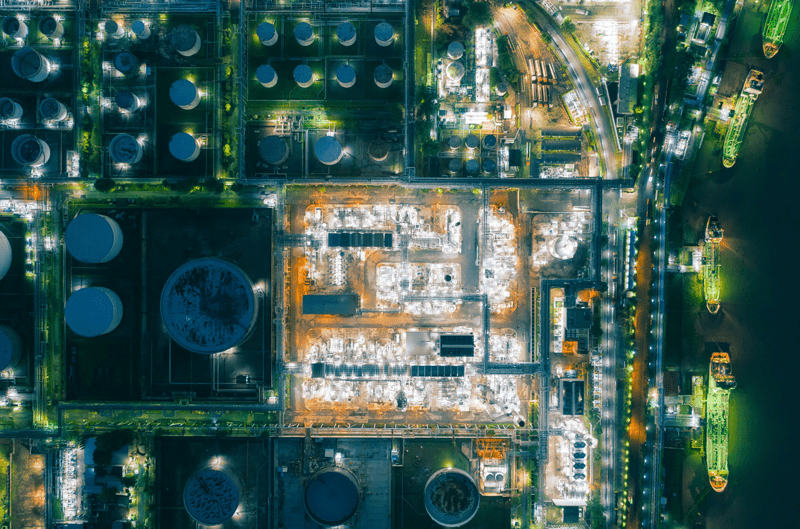

For 125 years, Phillips 66’s San Francisco refinery in Rodeo, California, processed only crude oil. But that changed this spring, when the transformed facility reopened as one of the world’s largest renewable transportation fuel production sites, with output expected to ramp up to 50,000 barrels per day of renewable diesel (RD) and sustainable aviation fuel (SAF) from feedstocks like used cooking oil.

Meanwhile, by the first quarter of 2025, global chemical company LyondellBasell intends to close its Houston, Texas, refinery and begin a similar conversion process as part of a strategy to exit oil refining and build a circular (reuse) and low-carbon solutions business, with the transformed plant envisioned as a regional hub for production and distribution of renewable fuels. The company, which has other conversion projects in development elsewhere, said it is evaluating which feedstocks and fuels to use and produce at the plant, with recycled and renewable-based feedstocks, and green and blue hydrogen, among the options.

Since 2010, the total number of operating refineries in the U.S. has decreased from close to 140 to about 125, according to McKinsey. At least eight of those closures, including Rodeo, have come since 2020, though not all those sites are being reborn as renewable fuel producers. That’s because, as McKinsey notes, “Building the business case to convert a refinery is complex and challenging – and compelling for only a few dozen refineries.”

However, with the world moving to more sustainable, less carbon-intensive energy sources as a result of more stringent regulations, shifting business strategies, and pressure from shareholders and investors, the business case to turn existing oil refineries into renewable energy producers grows stronger. Companies often can execute a conversion faster and more cost-effectively than if they were to build a greenfield facility because they can use existing real estate, assets and infrastructure, avoiding the substantial added cost and headaches that come with permitting and building a facility from scratch.

The business case for converting an oil refinery to renewable fuels depends in part on government subsidies and tax breaks that make plant conversions and renewable fuel production more economically feasible. What’s more, McKinsey notes, converting refineries to process renewable feedstocks into RD and SAF also reduces the cost of complying with the renewable fuels standard known as RFS2.

Still, the business case for converting and operating such a facility isn’t wholly dependent on government support. In fact, the more intelligently and efficiently a company can convert and operate a converted facility, the more attractive the economics of that facility become, and the less dependent the company will be on government support to profitably operate the plant. That’s an important consideration in a world where government policy is prone to change, particularly with a federal election looming in late 2024.

Here, based on my experience supporting refinery operators in the shift to a more sustainable energy portfolio, are six best practices for successfully converting an oil refinery to produce renewable fuels.

- Use existing assets wherever it’s practical. Phillips 66 determined it could use existing process units at its revamped Rodeo facility. Likewise, LyondellBasell plans to use existing assets and infrastructure at the Houston site, including hydrotreaters, pipelines, tanks, utilities, buildings and laboratories, likely resulting in substantial capital cost savings.

- Develop a fully integrated, cloud-based digital infrastructure to run the plant. Having a seamlessly integrated digital infrastructure housed in the cloud enables operational data and insight to flow to decision-makers across the business, which in turn leads to improved process efficiency, asset performance, workforce management, responsiveness to changing market conditions, and overall plant productivity. What’s more, by housing systems in the cloud, plant operators benefit from greater scalability and flexibility with their IT infrastructure. It also gives them access to market-standard practices (developed collaboratively by some of the energy industry’s largest players and available as an open platform to energy companies), so they don’t have to invest in costly proprietary processes and systems for non-differentiating business processes.

- Incorporate intelligent automation in tandem with connected assets. Artificial intelligence- and machine learning-driven capabilities enable refinery operators to infuse their operations with automation, not only in production processes, but in business processes. More energy companies are using robotic process automation, or RPA, to automate planning and scheduling, for example.

As heavily as intelligent capabilities like these rely on current, relevant data, it’s also important for plant operators to digitally connect and network assets at a site. By collecting and analyzing data from these Internet of Things-connected assets, AI- and ML-driven systems can illuminate ways to make specific processes more efficient and lower-emitting. The strides energy producers make today with automation lay the groundwork for “lights-out” operations, where a plant can run with minimal human involvement. - Use predictive tools to maintain assets. Using predictive analytics powered by AI (such as with a digital twin, a digital representation of a physical asset, system, process, etc.), gives operators deeper insight into how their assets are running, along with proactive suggestions regarding maintenance, potential repairs, etc., so that issues can be addressed proactively, before they disrupt an operation.

- Implement track-and-track capabilities for the energy molecule’s entire journey. With climate-related disclosure laws taking hold here in the U.S. (the SEC just finalized its policy in March) as well as abroad in Europe and elsewhere, energy producers must arm themselves with capabilities that enable them to collect, calculate and report actual carbon footprint and emissions data associated with their activities, including not only internal operations, but also from extraction, transportation and across the entire value chain (Scope 3 emissions).

- Network your supply chain. By connecting digitally with other segments of the supply chain, both upstream and downstream, fuel producers can share data with others in the network so they all can be more responsive, flexible and agile with their supply chain decisions, better manage risk, and identify the most sustainable pathways for getting products to market. If one feedstock source is disrupted, for example, a plant operator should be able to rapidly shift to a secondary source so production can continue without interruption.

As McKinsey points out, transforming an oil refinery into a renewable fuels production facility is “no simple switch.” But adhering to these best practices can smooth the transition process, helping companies stay profitable as they move to a lower-carbon, sustainable energy mix.

Stephane Lauzon is the head of the oil, gas and energy industry at SAP.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.