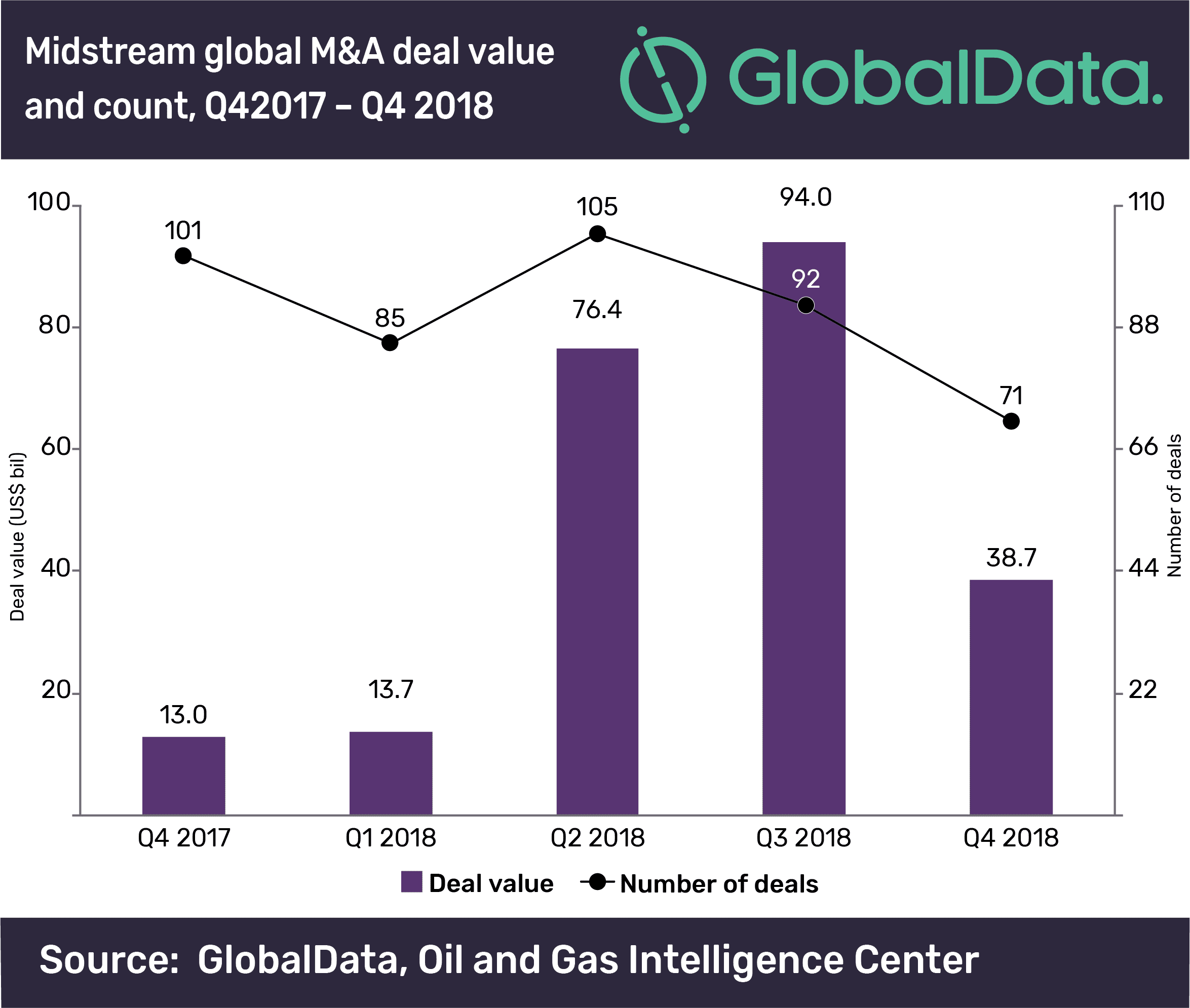

A total of 71 M&A deals with a combined value of US$38.7bn were registered in the midstream oil and gas industry in Q4 2018, according to GlobalData, a leading data and analytics company.

Of the total M&A deals, 44 deals, with a combined value of US$28.5bn were domestic acquisitions. The remaining 27, with a combined value of US$10.3bn, were cross-border transactions. A quarter-on-quarter comparison shows a marginal decrease in cross-border transaction values in Q4 2018, compared to US$10.4bn in Q3 2018. However, domestic transaction values decreased by 66 percent in Q4 2018, compared to US$83.6bn in Q3 2018.

The company’s latest report: ‘Quarterly Midstream M& Deals Review – Q4 2018’ states that there were 24 midstream M&A deals (with values greater than US$100 million), together accounting for US$38.1 billion, compared with 28 deals worth US$93.3 billion in Q3 2018, representing a decrease of 14 percent in the number of deals.

Europe, Middle East, and Africa accounted for 32 percent share in Q4 2018, comprising 23 acquisitions, of which 12 were cross-border and the remaining 11 were domestic acquisitions. The Asia-Pacific region accounted for 12 global deals in Q4 2018, of which eight were cross-border acquisitions and the remaining four were domestic acquisitions.

Praveen Karnati, Oil and Gas Analyst at GlobalData comments, “Americas remained the frontrunner for M&A registering 37 deals, with a total value of US$30bn in Q4 2018. Cross-border activity in the region increased from seven in Q3 2018 to eight in Q4 2018, while domestic acquisitions also increased from 28 deals in Q3 2018 to 29 in Q4 2018.”

EnLink Midstream’s definitive agreement to acquire the remaining 78.3 percent interest in EnLink Midstream Partners was the top deal registered in Q4 2018. The transaction is estimated to have an enterprise value of approximately US$8.6bn and an equity value of approximately US$5.1bn. Another landmark deal that was recorded in Q4 2018 was Antero Midstream GP’s agreement to acquire Antero Midstream. The transaction has an enterprise value of approximately US$7.2bn. The total equity value of the transaction is approximately US$5.8bn.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.