Natural gas had an extremely good year in 2022.

Production in the United States set a record, and international and domestic markets continue to expand and show strength.

However, a new report from the Energy Information Administration (EIA) at the U.S. Department of Energy points out several challenges ahead.

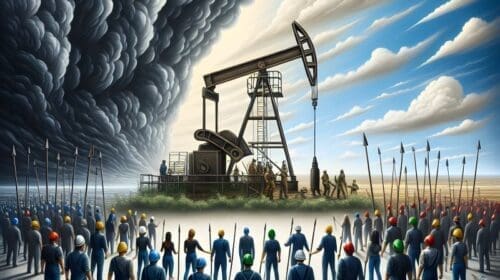

Sustaining production growth depends on the continuous drilling of new wells because soon after production starts from new wells they begin to decline. “Stronger or weaker prospects for natural gas prices and resource development costs will affect production over time,” EIA said.

Natural gas prices in the U.S. were up and down in 2022 rising to a high of $9 per million British thermal units (mmBtu) during the summer and declining 41 percent to an average of $2.26 in January, according to EIA. EIA attributed the decline in price to a 15 percent decline in demand primarily due to warmer temperatures and an increase in inventories.

Exploration and production companies improved productivity over the years through many technological advancements, such as drilling longer horizontal segments of wells, drilling multiple wells from the same location, deploying new types of rigs, and optimizing well-spacing and locations.

The outlook for growing production during the next two years will depend on how well exploration and production companies can address inflation, labor needs, material and equipment shortages, access to capital, and the need for more transportation capacity from the wellhead to consumers.

The COVID-19 pandemic illustrates the effect of macroeconomic trends as demand declined during the outbreak in 2020 but recovered in 2021 and increased again in 2022 as industrial activity expanded, EIA stated.

Liquefied natural gas (LNG) international market made outstanding gains in 2022. U.S. LNG export facilities operated close to maximum utilization rates, averaging 87 percent in the first half of the year, and EIA expects they will continue to operate at high utilization rates through 2024.

“China’s continued economic recovery from the pandemic and Russia’s full-scale invasion of Ukraine are likely to keep international natural gas prices elevated relative to the United States, encouraging high and sustained levels of LNG exports,” EIA said.

EIA projects some competition from wind and solar as they add about 38 gigawatts (GW) – 23 GW of solar, 7 GW of wind, and 8 GW of battery storage – of new capacity from October 2022 to September 2023.

“We expect the new generating capacity to backfill retiring coal plants and displace some natural gas-fired generation,” EIA stated. “We forecast that a combination of solar photovoltaic and wind generation will account for 18 percent of U.S. generation in 2024, up from 16 percent this year.”

The deployment of natural gas combined-cycle gas turbine (CCGT) plants is slowing after decades of growth. Developers and project planners plan to add about 5 GW of new CCGT capacity in 2023, but after that, the number of confirmed new projects drops considerably.

Alex Mills is the former President of the Texas Alliance of Energy Producers.

Alex Mills is the former President of the Texas Alliance of Energy Producers. The Alliance is the largest state oil and gas associations in the nation with more than 3,000 members in 305 cities and 28 states.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.