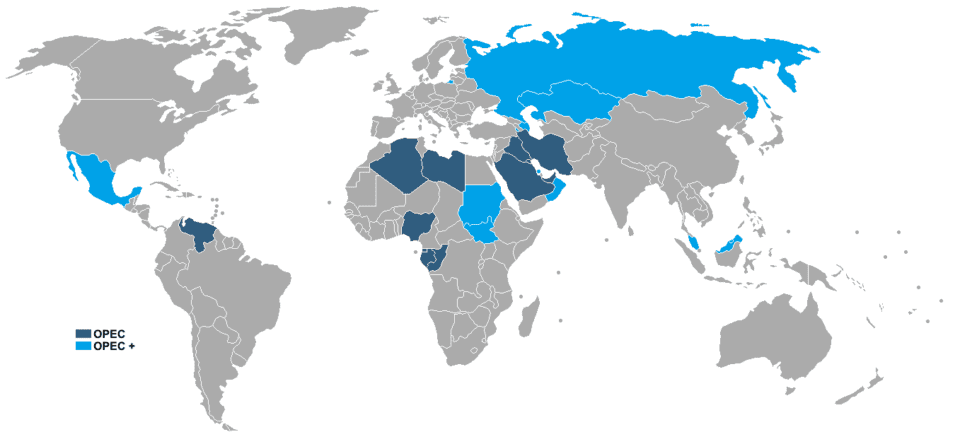

The Organization of Petroleum Exporting Countries – better known as OPEC – has become the major source of crude oil exports worldwide. During the pandemic, it took in several additional countries, including Russia and it became known as OPEC+.

The 22 countries of OPEC+ provided 27% of the world’s crude oil, with Saudi Arabia and Russia leading the other nations with production totals of roughly 10 million barrels per day (b/d) each.

As time passed and worldwide demand changed, OPEC+ reduced its production quotas in an effort to reduce the amount of oil on the market. Saudi Arabia’s currently produces 9 million b/d. Russia’s current production is more difficult to determine because of sanctions placed on it by the U.S. and other countries after Russia invaded Ukraine two years ago, but it is estimated to be about 8 million b/d.

Global inflation and slow economic growth resulted in less demand for oil from these countries in recent years.

At the same time, oil production in the U.S. increased to a high of 13 million b/d by the end of 2023.

An oversupply of oil caused a weakening in price. Brent crude, which is traded on the international market, dropped, as did West Texas Intermediate, which is traded on the New York Mercantile Exchange, below $60 per barrel.

OPEC+ has reduced production quotas five times since October 2022 in an effort to stop the decline.

Brent crude oil closed at $80.29 and WTI closed at $75.40 on Jan. 24.

OPEC expects demand to increase by 2% during the coming months to 104.36 million b/d, according to its forecast released this week. OPEC projects demand increasing 2.25 million b/d in 2024 and 1.8 million b/d in 2025.

OPEC’s projections appear to be very optimistic on the demand side of the equation. Several major factors that could negatively impact demand include Russia’s war with Ukraine, the escalation of the Israeli-Hamas conflict, Iran’s involvement in the fighting, and China’s economy needs to improve.

On the other hand, inflation has diminished but is still a concern, and the economy of the European Union is recovering.

If demand continues to increase as supplies remain at the current level, prices should remain close to current levels. Any pressure on the availability of supplies will put pressure on prices to rise.

Alex Mills is the former President of the Texas Alliance of Energy Producers.

Alex Mills is the former President of the Texas Alliance of Energy Producers. The Alliance is the largest state oil and gas associations in the nation with more than 3,000 members in 305 cities and 28 states.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.