Author Profile

Eissler, former editor-in- chief of Oil & Gas Engineering magazine, previously worked as an editor for Dubai-based The Oil & Gas Year Magazine.

3 Ways Technology is Going to Shape the Oil and Gas Industry Free to Download Today

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.

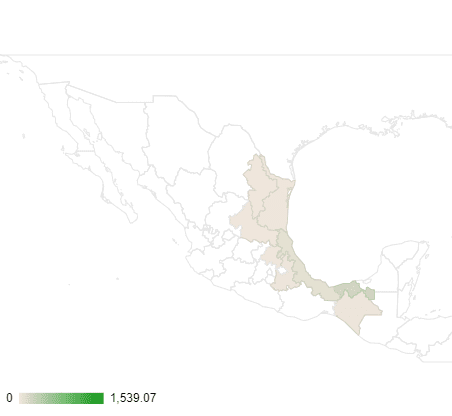

Source: National Hydrocarbons Commission – Mexico

Source: National Hydrocarbons Commission – Mexico