The oil and gas industry resembled an action-packed television series in 2023. The plot thickened with each day and – just when you thought you had a handle on things – ExxonMobil moved to acquire Pioneer Natural Resources for $59.5 billion. The industry hardly had time to process the announcement before the second shot of an acquisition double header surfaced, with Chevron buying Hess for $53 billion.

The industry gossip slowed, and the industry continued to maintain daily business with the year’s close approaching. One more unexpected twist would arise with Occidental Petroleum announcing its intent to purchase CrownRock LP, a privately held producer operating in the Permian Basin, for $12 billion.

Not that the entire 2023 history was predictable, but industry professionals almost knew what to expect when combatting production issues and geopolitical tension. However, the acquisition and divestiture (A&D) facet proved to be something that no one had yet planned to occur. As the books come to a close in 2023 and an accurate measurement is taken of what worked and what did not, it could undoubtedly dictate how A&D might levy an influence on 2024.

A&D are strategies utilized to increase an organization’s value. The actual objectives called upon fluctuate and are dependent upon the specific nature of the individual deal. The common theme, however, can be found in increasing value while limiting risk.

According to Andrew Dittmar, Senior VP of Enverus Intelligence, A&D commands a piece of the oil and gas industry because of the focus on asset sales. Those assets can be separated or divided, allowing for a partial sale of the particular market share.

“There is no intellectual piece when it comes to oil and gas,” says Dittmar. “It is more like selling real estate.”

Companies concentrating on shoring up or expanding their portfolios focus on specific factors guiding the decision-making process. Operators analyze geological data of different formations to determine if the assets available score appropriately to help reach financial goals. The outcome desired from the data research is that expertise and success can be harnessed to increase margin recovery.

According to Dittmar, companies can use various methods when acquiring another’s assets. Its financial health during the acquisition is influential in determining the best route to fund the project.

“One can pay with cash, but it takes a solid balance sheet,” says Dittmar. “Acquisitions with public companies allow the ability to issue stock instead of relying on the condition of the balance sheet.”

Using the most economically friendly funding process helps to realize the highest profit potential from the assets acquired. While one hopes for economic gains from the acquisition, the opposing party divesting the particular assets finds a different motivation.

“A company might choose to divest a group of assets because the value of the sale is much better than the value associated with carrying it,” says Dittmar.

Oil and gas companies might choose to divest assets for other reasons. The process can be used to escape financial fault, but investor relations can also drive it.

“In the past, oil and gas companies were forced to divest assets due to mismanagement,” says Dittmar, “but that has not been the case for a long time.”

In the dealings of industry icons like Chevron and ExxonMobil, increasing market share has been the common theme. Dittmar foresees A&D activity in 2024, but not to the extent witnessed in 2023 with the more prominent players.

“I think we will see more deals in 2024, but not of the same scale as ExxonMobil acquiring Pioneer and Chevron taking Hess. Instead, I think we will witness more within the private sector.”

Dittmar predicts the private sector’s A&D uptick will primarily be directed at U.S. shale. Shale formations prove much more attractive with lower risk factors than other plays, like the Gulf of Mexico offshore sector.

According to Dittmar, the Midcon in Oklahoma and the Eagle Ford in Texas comprise many private operating companies. Depending upon the blueprint of financial success, some might decide to exit while making a profit and divesting their market share. Others planning for the extended stay might capitalize on those same acquisitions.

“The Haynesville is seeing a serious increase in activity with the demand for LNG on the Gulf Coast, so that we might see some A&D activity there,” says Dittmar. “Overall, though, the Permian Basin will be the epicenter of A&D dealings.”

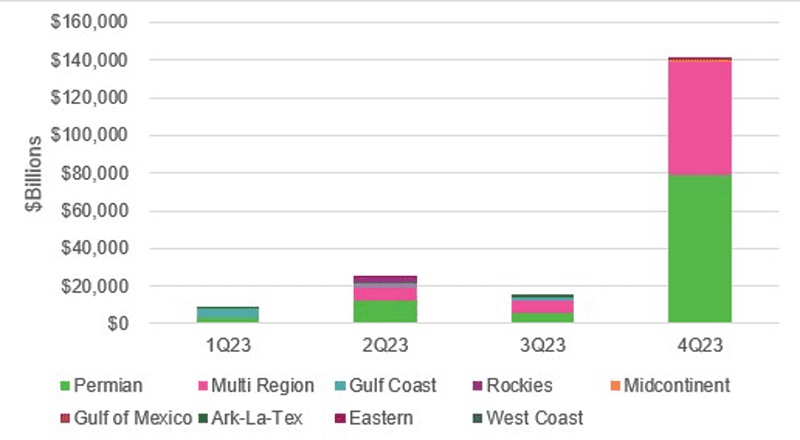

The potential of U.S. shale A&D activity in 2024 seems ironclad when analyzing 2023’s final statistical data. Enverus M&A Analytics released a summary of data broken down by shale regions. The first quarter appeared sluggish in activity, but the Permian still commanded the majority of dealings. The second quarter increased in A&D, but activity regressed in the third; however, it still finished higher than the first quarter. 2023’s fourth quarter, however, proved to be the black horse and finished far surpassing the other quarters in deal value.

In all calculations including all four quarters, the Permian Basin commanded the majority of A&D activity. Located between Texas and New Mexico, the Permian controls a high production rate, but also possesses growth opportunities due to untapped reserves and infrastructure potential. A&D activity on what some might consider a more minor scale further supports the interest directed at the Permian. Civitas Resources spent $4.7 billion on acquiring Tap Rock Resources and Hibernia Energy III, two private equity properties, and Permian assets. Ovintiv directed $4.3 billion on three Permian acquisitions, while Permian Resources levied $4.5 billion for Earthstone Energy.

Permian Resources continued its A&D trends by divesting non-operated producing properties accounting for an approximate 1,800 Boe/d. This included 3,500 acres in Texas’ Reeves County for $60 million. The company additionally divested another 300 net leasehold acres in Eddy County, New Mexico, for a per net acre price of $35,000. This deal produced almost $10 million of total net proceeds.

This A&D movement illuminates the private sector’s growing interest. The large deals made in 2023 will likely remain the same in 2024. Dittmar ratifies this notion simply because only so many players have the financial capability to do the same. If you are a resident of the Gulf Coast, the large deals of 2023 carry a similar influence as the once-in-a-lifetime hurricanes like Katrina and Andrew.

With the oil and gas industry steaming ahead in 2024, A & D activity could show movement early in the year. Considering the stronghold of numerous geopolitical tensions on the world, sways in uncertainty, and the desire to take advantage of workable markets, the time is now for smaller companies to shore up their balance sheets. Divesting assets in less active regions provides financial means to acquire additional assets that will levy profits. With the production rates provided by the Permian and the demand for natural gas, whether for potential global export or to meet the LNG needs, A&D activity is forecasted to concentrate heavily in the West Texas and New Mexico geographical areas. Determining who sells and who buys will attract attention to the 2024 oil and gas activity.

Nick Vaccaro is a freelance writer and photographer. In addition to providing technical writing services, he is an HSE consultant in the oil and gas industry with twelve years of experience. Vaccaro also contributes to SHALE Oil and Gas Business Magazine, American Oil and Gas Investor, Oil and Gas Investor, Energies Magazine and Louisiana Sportsman Magazine. He has a BA in photojournalism from Loyola University and resides in the New Orleans area. Vaccaro can be reached at 985-966-0957 or nav@vaccarogroupllc.com.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.