To stay afloat in this highly volatile market, exploration and productions (E&P) companies rely on high cash flow by reducing their Capex (capital expenditures) and Opex (operational expenditures), which directly strains oilfield services and equipment (OFSE) companies. The reduction is significant in drilling new wells, aggravating the oil market’s volatility by reducing the oil supply and decreasing hydrocarbon availability. However, because OFSE and E&P companies both depend on the technical expertise of OFSEs for their project success, they must work toward creating value, not claiming the values. E&P and OFSE must understand the entire value chain and develop modified commercial models that are win-win for both.

E&P companies have adjusted contracts for risk-reward sharing, prompting OFSEs to adopt a performance-driven strategy with integration and synergy at its core. To find work in the cost-driven market, OFSEs strive to secure integrated multi-product line contracts that foster synergy among their offerings, improving performance and efficiency and reducing operating costs.

An integrated commercial model offers today’s exploration and production companies a comprehensive approach that combines drilling-related services, technologies, and expertise into a unified package and encompasses drilling engineering, project management, equipment rental, logistics, data analysis and other components.

The latest trends indicate that E&Ps seek comprehensive solutions for their well construction and production processes. This demand has led large OFSEs to offer lump-sum services covering all well-site operations by expanding their existing workflow and addressing gaps in their portfolio. Consequently, several OFSEs are in a position to deliver complete end-to-end solutions for entire well constructions and production value chains through integrated services.

Discrete Service Model and Value Claiming

In the past, OFSE companies were invited by E&P companies to bid on different aspects of well construction including directional drilling services, drilling fluid services, cementing services, completion equipment services, and more drilling execution work.

E&P companies selected vendors on pricing and technological schedules included in the bids, often selecting several different OFSE vendors for the same project., assigning each vendor different key performance objectives (KPO).

While this approach provided E&P companies with autonomy and control, it lacked synergy throughout the value chain. In a high oil price environment, efficiency and performance enhancement become crucial when oil prices are low. Additionally, in discrete service models, OFSE companies could not benefit from remote services, reduced crew, and cross-trained personnel, all of which are vital for improving commercial success. The discrete services model lacks optimization for these activities as it involves multiple vendors. OFSE companies under time-based contracts, tend to benefit from these inefficiencies (accounting for ILT).

Instead, companies should use an integrated commercial model as it provides a comprehensive approach that combines drilling-related services, technologies and expertise into a unified package. It encompasses drilling engineering, project management, equipment rental, logistics, data analysis and other components for successful operations.

These models are often referred to as integrated drilling services (IDS). Larger OFSE companies realized this potential recently, resulting in multiple acquisitions and portfolio expansion to cover the well lifecycle. OFSE companies offering integrated services can reduce costs through remote operations, reduced crew, cross-trained workforce and enhanced technical solutions such as bit designing, BHA design, mud design, cement design and data analytics. It also helps E&P operators to have a single responsible party and foster interdisciplinary team efforts.

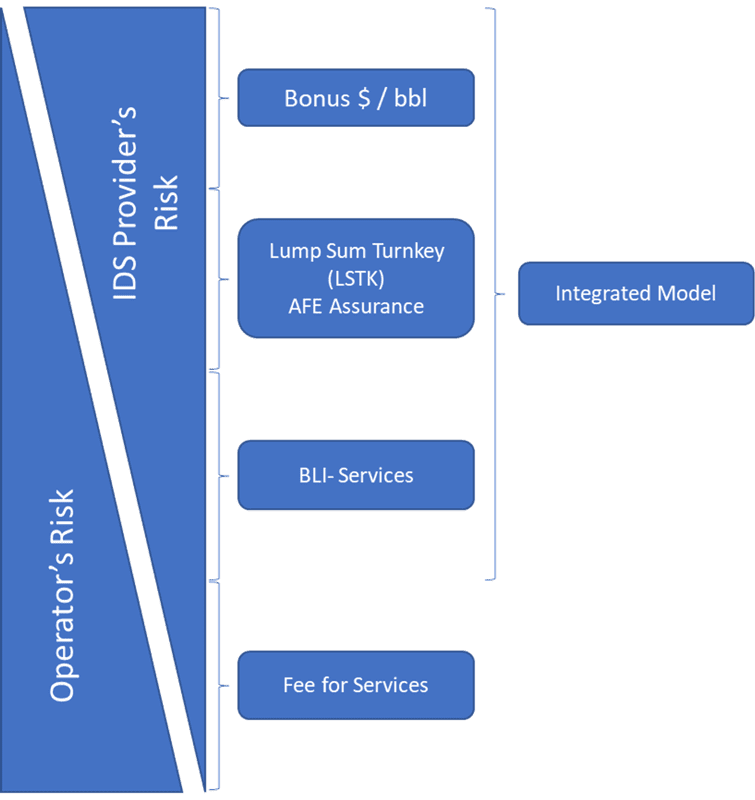

Integrated oil and gas industry models vary based on the risk level involved. Here are some areas that vary by risk:

- Fee for services

- Business line integration

- AFE assurance

- Lump sum turnkey

- $ Bonus/bbl of hydrocarbon

Figure-01 captures multiple commercial models and risk factors for the EFSE vendor offering specific services at a defined fee/day rate. As the OFSE vendor’s revenue is time-and-quantity-driven, more time translates to higher earnings.

The most basic integration model is called bundled services. Under this commercial agreement, an OFSE vendor is awarded more than three business lines’ services for a well. They can optimize their resources to reduce costs and have a dedicated project manager for better coordination between business lines.

The integration model, where the OFSE vendor’s revenue and well production are linked, is considered the riskiest. However, the reward is higher if the well meets the production target.

Many integration model variations exist based on the risk tailored to the project demand. Risk management becomes the most critical factor in any integration model, as this risk can be positive or negative. E&P operators and OFSE vendors should approach discussions open-mindedly. To ensure controlled risk and avoid conflicts, it is essential to establish clear and close-ended terms and conditions, preventing open-ended agreements.

IDS providers (OFSE) work closely with E&P operators to develop customized solutions that meet project requirements, leading to enhanced efficiency and a seamless drilling process. However, several components of IDS contribute significantly to achieving synergy and promoting engineering and operational excellence.

Key Components of IDS

- Drilling Engineering and Planning: IDS covers several drilling engineering and planning services, including designing well trajectories, casing, cementing programs, developing drilling fluids, and well construction strategies. IDS providers utilize their advanced engineering knowledge and global expertise to assist operators in optimizing their drilling performance and achieving the best outcomes.

- Project Management: Effective project management is crucial for IDS due to inherent risks in integration models. Planning and managing the inherent risks in integration models are essential for avoiding disastrous outcomes, including health, safety and environment (HSE), logistics, and resource allocation.

- Advanced Drilling Technologies and Equipment: IDS providers utilize cutting-edge drilling technologies and equipment to enhance drilling operations, including advanced drill bits, measurement-while-drilling (MWD) tools, and logging-while-drilling (LWD) systems that provide real-time data for precise decision-making. They offer access to modern drilling rigs and associated equipment, ensuring efficient and reliable drilling performance.

- Real-time Data Analysis and Reporting: IDS incorporates real-time data analysis capabilities, enabling operators to make informed decisions. IDS providers collect and analyze data from several sources to identify potential issues, optimize drilling parameters, and mitigate real-time risks. Detailed reporting and performance analysis help operators evaluate and fine-tune drilling strategies for improved efficiency.

Benefits of IDS

- Improved Well Design and Planning: IDS providers leverage advanced technologies, data analytics, and global experience to design wells. They employ cutting-edge technology, including finite element analysis, to engineer drill bits, enhancing drilling performance and reducing NPT caused by downhole tool failures. Through advanced planning and design, IDS can improve well quality and minimize NPT events.

- Enhanced Drilling Efficiency and Performance: IDS providers integrate various drilling services and technologies, optimizing the drilling process. With integrated workflows, data analysis, and project management, IDS minimizes downtime, improves drilling rates, and maximizes overall operational efficiency.

- Cost Optimization: IDS helps operators reduce costs through effective project management, streamlined logistics, and optimized drilling strategies without compromising quality or safety by eliminating redundancies and leveraging economies of scale.

- Safety and Risk Management: IDS is centered around effective risk management to safeguard OFSE and E&P companies. With robust risk assessment methodologies, real-time data analysis, and adherence to industry best practices, IDS minimizes potential hazards, enhances wellbore integrity, and ensures the well-being of personnel and assets.

- Access to Expertise and Resources: IDS offers operators diverse expertise and resources. IDS providers, being at the forefront of developing advanced technologies, enhance sub-surface understanding. Through partnerships, operators can leverage the specialized technology, knowledge and experience of industry professionals, ensuring optimal drilling performance and successful project execution.

- Optimized Well Delivery and Lifecycle: IDS excels in integrating drilling operations with subsequent phases of the well lifecycle, including completion, stimulation, intervention, workover and abandonment. This seamless integration ensures a smooth transition between phases and maximizes well value throughout its lifespan.

The symbiotic relationship between E&P and OFSE companies through IDS creates value and benefits all stakeholders. IDS has emerged as a boon for the drilling industry in the current volatile oil market, utilizing advanced technology and global expertise to enhance performance and maintain low costs.

Mohit Kumar began his remarkable journey in a small village near Agra, India, and today is an oil and gas industry leader in Anchorage, Alaska.

Growing up in a farming family, he overcame numerous obstacles and emerged as one of the top performers in the prestigious IIT-JEE examination, securing the 3303rd All India Rank out of over 700,000 students. This achievement paved the way for him to study petroleum engineering at the Indian Institute of Technology (ISM), Dhanbad, from where he graduated with honors in 2008.

Today, Kumar serves as an account manager for one of the world’s largest oilfield service companies, residing in Alaska. Progressing from project manager to account manager within a year of joining the company, his expertise lies in building and executing value-based commercial models to deliver cutting-edge technological solutions in the oil and gas industry, contributing to the growth and success of his organization in Alaska.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.