This year, Russia invaded Ukraine, threatening not just the sovereignty of European nations, but also the world energy market. When America, along with our allies and trade partners, rightfully sanctioned Russia, refusing to fill Moscow’s coffers, the global energy market was impacted. American LNG has served as a tourniquet, staunching the possibly devastating economic impact of removing one of the world’s largest energy producers from the world stage.

Energy expert and author Daniel Yergin, in a recent interview, best summed up America’s energy position like this: “Today, we [the United States] are basically self-sufficient, if you look on a net basis. And we’re the world’s largest oil producer. And this was unthinkable a decade and a half ago.”

And that great leap – from unthinkable to our reality – is entirely credited to American oil and gas producers.

American energy production, driven by national leader Texas, has transformed the global oil and gas industry. Since 2012, crude oil production has risen 95 percent and natural gas production has risen 46 percent. In Texas’ Permian Basin, total oil and gas production increased over 320 percent between 2011 and 2020. And Texas single-handedly accounts for roughly a quarter of U.S. natural gas production. With this prolific production, it came as no surprise that in 2020 we crossed the threshold from net petroleum importer to net exporter.

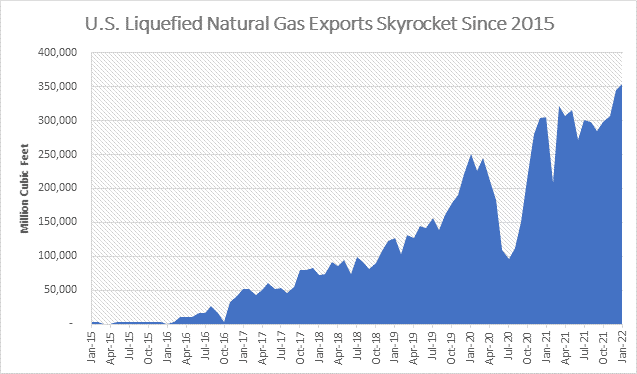

Hand-in-hand with rapidly growing energy production, America’s investment in liquified natural gas (LNG) infrastructure over the past several years has proved not just to be a boon, but a necessity. The lower 48 states only began exporting LNG in February 2016. Just over five years later, the United States officially became the world’s leading LNG exporter, surpassing Russia. And once again, it is Texas energy that made it possible. The coasts of Texas and Louisiana have become home to our country’s largest LNG export terminals, and more than 85 percent of the additional planned U.S. LNG export capacity will be located in the Gulf of Mexico and supplied largely by Texas natural gas.

In short, the shale revolution delivered energy security that we had not held in decades.

Our ability to wield that energy security has proven invaluable. Thanks to American oil and gas supply, Russia could not as easily leverage its energy supply against EU leaders. To put into context the dependence of Europe on Russian energy, consider this: Russia provided 20 percent of Europe’s LNG imports in 2021. That same year, the United States was providing just over a quarter of Europe’s LNG imports – which means to fill the void left by Russia, the U.S. would need to almost double our LNG exports to the region. And so far, we’ve successfully done so.

In January alone, the United States supplied more than half of the LNG imports into Europe. However, we’ve promised to deliver much, much more. At the end of March, President Biden pledged to supply Europe with an additional 15 billion cubic meters of LNG by the end of this year to offset imports from Russia. Beyond Europe, global LNG demand is also set to surge, both in the short and long term. By 2040, world demand for LNG is projected to increase 90 percent, compared to 2021 consumption levels.

If we are to keep up with our promises to Europe, and broader global demand, we will need to push our LNG export capacity even further. In November 2021, the EIA estimated that U.S. LNG nominal liquefaction capacity was 9.5 Bcf/d and peak capacity was 11.6 Bcf/d. And yet, as it currently stands, the export terminals along the Gulf Coast have already been strained.

In February of this year, LNG tankers were docked or loading at all seven U.S. LNG export terminals. To expand our capacity, many have called for the Federal Energy Regulatory Commission (FERC) and other agencies to expedite approval on proposed export terminal projects. Approvals aimed at improving our capacity in the short-term are already underway.

In mid-March, the Department of Energy (DOE) issued two orders authorizing LNG exports from two current operating LNG export projects, Cheniere Energy Inc.’s Sabine Pass in Louisiana, and another in Corpus Christi, Texas. However, America must prepare for the long term demands on our LNG capacity, particularly as it can take years to get a project online. For example, NextDecade’s proposed Rio Grande LNG export terminal, which could produce 27 million cubic meters of LNG per year, is not yet approved. If given the green light, it could start commercial operations as early as 2026-28. That is just one of many projects in the pipeline, and these projects simply cannot come online soon enough.

The U.S. stands where we are today – filling the gaping hole left by Russian oil, supporting our allies, and as a global energy leader – thanks to the innovation and hard work of the oil and gas industry. But what has become clear is that has not been deemed enough by many politicians.

Congressional leaders have been calling oil and gas executives into hearings to interrogate them on why oil prices have risen in the face of extreme shocks to the global market. Ignoring the obvious answer that American companies are subject to the prices set by the global market, many politicians have instead chosen to accuse the energy industry of price gouging and seek to set additional taxes – like the windfall tax – on American oil and gas corporations.

In the same breath they choose to villainize the energy industry, these politicians fail to acknowledge that in an alternate world – one that many have advocated for, where Texas energy production was stifled, and calls to “end fossil fuels” succeeded – that we would be in a dire situation, perhaps equivalent to the frightening oil and gas shortages of the 1970s. In that scenario, President Biden’s administration may have been forced to negotiate with Putin rather than firmly defend democracy. Putin has previously denounced shale, and he has done so because he recognized that shale provided the United States with flexibility in our foreign policy, and with new and strengthened trading partners.

Looking to the future, we must continue to embrace oil and gas. Investing in both our energy production and infrastructure will help fortify America against the next threat. Energy independence and energy security are versatile tools that we will need both today and tomorrow.

TIPRO is a trade association representing the interests of nearly 3,000 independent oil and natural gas producers and royalty owners throughout Texas. As the largest statewide association in Texas that represents both independent producers and royalty owners, members include small businesses, the largest, publicly-traded independent producers, and mineral owners, estates, and trusts.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.