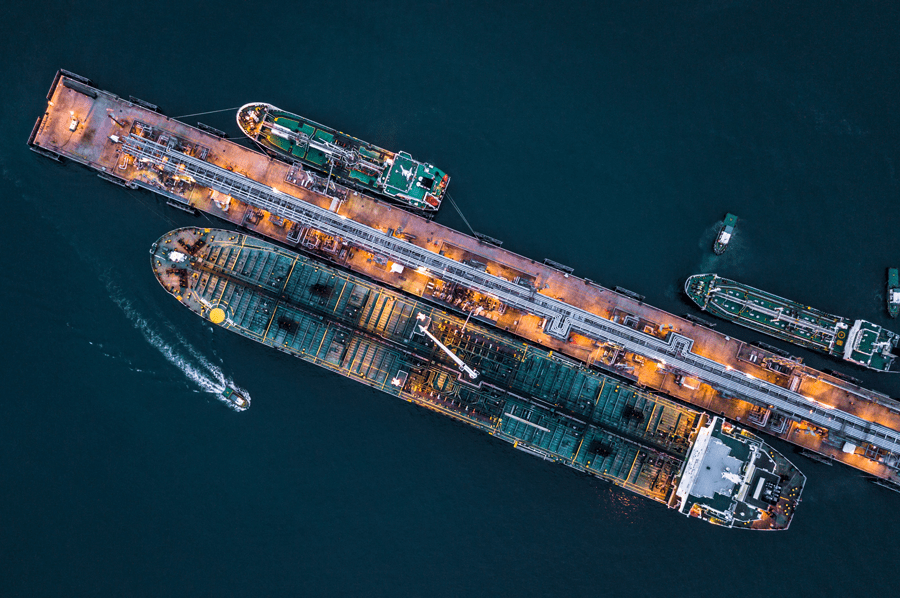

U.S. energy markets continue to evolve, shaped by demand disruption on a global and local scale, price volatility, and increasing demand for specific commodities like natural gas and LNG. Energy trading is a complex business that involves large numbers of oil field transactions and a big dance that requires traders to continuously coordinate supply and demand with the movement of commodities over multiple types of transport, including truck, rail, pipeline and barge. The dance involves not just produced products, such as crude, gas and natural gas liquids, energy trading extends across the supply chain into finished fuels and refined products.

Consider the energy requirements for a typical hydraulic fracturing job. Margins are frequently narrow for energy traders who supply diesel fuel for frac spreads, underscoring the need to precisely gauge demand, and supply these fuel intensive oil field operations with exactly the right volume. With a typical hydraulic fracturing operation requiring one million gallons of diesel, even a small miscalculation can result in significant monetary loss.

Adding complexity to the big transportation dance is managing driver demurrage, the costs incurred by shippers when freight is delayed and left sitting on a loading dock to be picked up or delivered. A truck waiting in line for hours to fuel a frac job is just one example of how a trader’s margins can be eroded by demurrage, making it imperative to the bottom line to schedule just-in-time arrivals and departures to prevent dancers from stumbling.

Energy Trading and Risk Management Defined

To operate efficiently and prevent financial losses, those in the business rely on energy trading and risk management (ETRM) solutions, which comprise digital technologies and the processes in place to execute trades, move commodities, and comply with regulatory agency reporting and tax. Gartner, the leading technology, research and consulting company, offers a well-rounded definition for ETRM:

ETRM involves commercial decision making and market execution using an integrated system that enables data exchanges among trade floor, operations, credit, contract and accounting functions. Integral to the process are event and trade identification/capture, comprehensive risk management strategies/policies, scheduling/nomination/transportation, and settlement execution. The process also provides for price transparency, market monitoring, controlled access and regulatory compliance.

The ETRM definition above does a good job of highlighting the fundamental challenges that energy traders face in managing so many moving parts. In the digital oil field, paper field tickets persist and systems for capturing transactions are often disconnected from market analysis and pricing data, the general ledger, accounts receivable and regulatory systems, which creates bottlenecks for cash flow. ETRM systems, by nature, also do a poor job of asset management, and an even poorer job of scheduling with time constraints and third-party providers.

Those in the business of selling finished fuels and refined products often feel like their organization is in the banking business. That’s because paper-based transactions, inconsistent routing of tickets from operations, and manual workflows delay accounts receivable invoices by months, which can feel like the seller is continuously lending money to buyers. Given the volume of transactions involved, teams can be out millions at any given time, underscoring the need for robust accounting processes that work in parallel with the logistical complexities of energy trading.

Unique Complexities of Finished Fuels and Refined Products

Traders must constantly track rack and index prices (such as OPIS and DTN), forecast monthly and annual weighted averages, and determine optimal times to load from yard, pickup from rack, stockpile, hold, and sell. Trading is fiercely competitive, leading oil field suppliers to optimize fleet movement to better service customers, the complex dance that involves continuous dispatch updates and analysis of electronic logging data (ELD) and driver utilization.

There are always risks involved in trading any type of commodity, whether buyers are basing their decisions on cyclical trends or speculating in a new market. For regulatory, service providers face major challenges in maintaining current physical position reports and ensuring DOT compliance. Trucking operations that cross state lines also inject additional complexity from the rigorous reporting requirements of the International Fuel Tax Agreement (IFTA).

Unlike contracts that are traded on the major commodity exchanges – like natural gas and crude oil – suppliers of finished fuels and refined products take physical custody of these commodities. That puts these traders in the transportation business, requiring companies to manage fleets of trucks and drivers in parallel with the back office and trading operations. With intensifying scrutiny of greenhouse gas emissions, traders must find ways not only to optimize their operating costs, but they must also minimize their carbon footprint while optimizing ESG.

Solving Transportation Management Challenges

What finished fuels and refined product traders need is a transportation management system (TMS) to manage the logistical complexities of trucking operations with ETRM capabilities for managing trades and risk. However, typical TMS solutions aimed at solving energy trading present cost and complexity overkill for the industry, and can take a year and massive capital outlay to deploy.

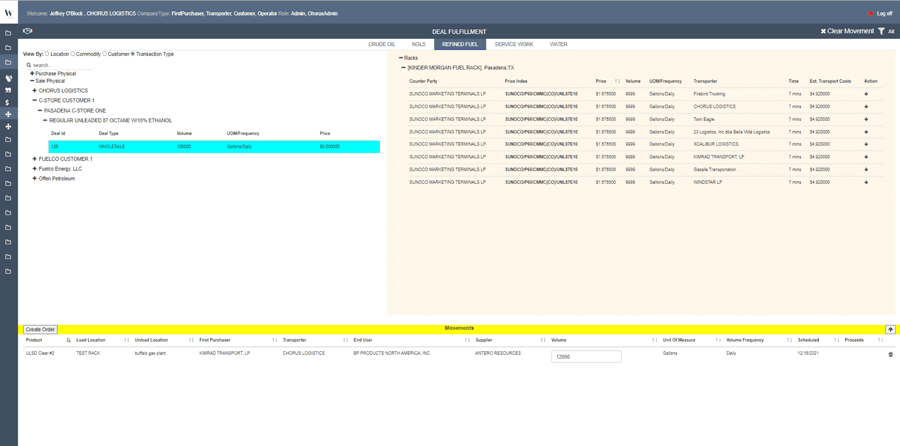

Combining a mobile app for drivers and a comprehensive back office suite for dispatch, inventory management, accounting and deal capture, W Energy Software’s TMS solution can be deployed in just weeks and at a fraction of the cost of “big box” solutions. The cloud-based solution automatically captures transactions and incorporates real-time index pricing of transportation cost data and rack prices into cloud-based deal fulfillment screens, enabling marketing teams to instantly view supplier and customer pricing, KPIs (e.g., run time, drive time, load/unload time), and margin calculations.

The TMS solution provides traders with the robust transportation management capabilities needed to manage shipments by truck as well as modern ETRM technology to gain unprecedented visibility into high volume transactions, enabling organizations to increase business performance and deal volume. Importantly, W Energy Software’s TMS is the only solution that provides seamless integration with a trader’s core financials, accelerating accounts receivable and cash flow while mitigating risks with automatically generated physical position reports, including IFTA.

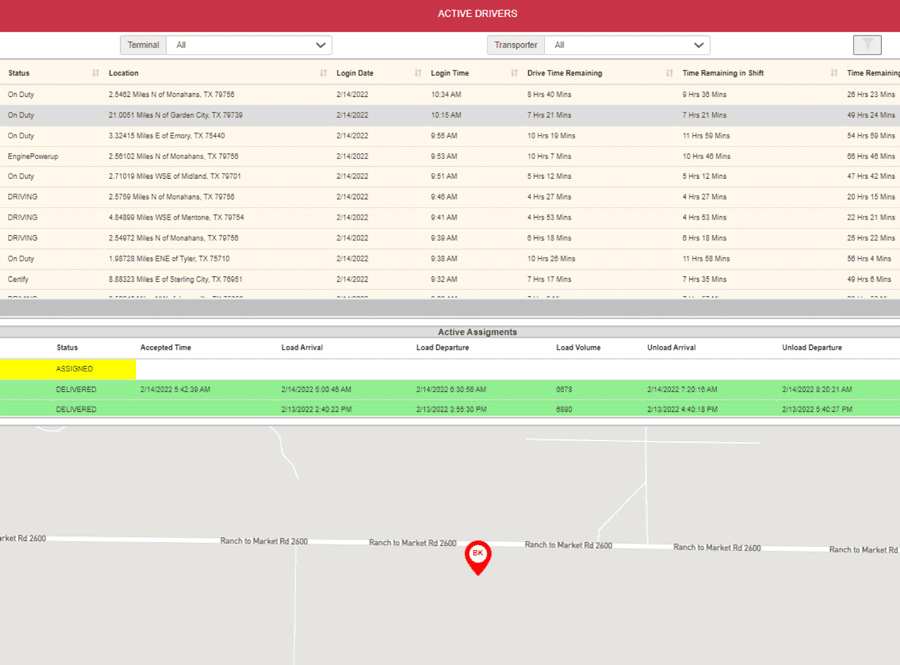

W Energy Software’s TMS enables continuous, real time communications with all available transporters, allowing the back office to choreograph the “big dance” of oil field transportation and ensure the fluid movement of trucks and the disposition of commodities at any given time. The real time communications unlocked by the cloud and mobile devices are also enabling predictive inventory – both long and short – at storage locations, virtually eliminating costly demurrage fees for trucking.

In oil field transportation, not everything goes as planned, requiring carriers, dispatchers and suppliers to collaborate around a wide variety of data to adapt plans and keep moving. The TMS solution eliminates data silos by integrating transportation contracts and commodity price feeds from price indexes in context with traffic and weather data. Additionally, with real-time visibility into prices at origin and destination locations, W Energy Software’s TMS provides shippers with increased optionality and enables rapid response to supply chain anomalies, increasing agility and improving margins.

Driving Operational Excellence at Scale

A leading wholesaler and marketing company procures finished fuels and refined products across North America. It supplies oil field operations throughout major basins, including fuel-intensive hydraulic fracturing.

The company had relied on manual, paper-based processes for a large number of monthly transactions, limiting accountability and visibility into buying. It operates a large fleet of trucks nationwide, adding operational and logistical complexity through reliance on paper run tickets and manual invoicing processes.

What’s more, paper-based processes, inconsistent routing of tickets from operations, and manual workflows delayed customer invoicing by two weeks and as much as two months, continuously impacting the company’s cash flow from delayed payments. With complex state tax obligations that vary from product to product, it also faced significant delays for regulatory reporting and taxes that often required three months to prepare.

To maximize deal margins, the oil field supplier wanted to incorporate real time rack and OPIS prices, automatically calculate monthly and annual weighted averages for multiple products, and determine optimal times to execute transactions. Its dispatch department wanted to better understand driver utilization and gain insights into ELD data to optimize fleetwide performance while minimizing driver turnover. And, in order to compete and improve service times for customers, the company needed to optimize truck routes by avoiding deadhead runs, bypassing road closures, and rerouting when storage terminals sell out.

The oil field supplier needed to maintain a current physical position report and ensure DOT compliance by capturing driver KPIs and certifications for trucks and drivers. It set out to find a solution that would also accelerate customer invoicing and tax preparation to improve cash flow and eliminate the time, costs and G&A associated with manual invoice processing and tax workflows.

The company deployed W Energy Software’s TMS and ETRM solution to automatically record transactions and integrate real time OPIS and rack prices. Through intuitive, cloud-based fulfillment screens, its marketing staff can instantly calculate margins, track suppliers and customer pricing, and view real time key performance indicators, including run, drive and load times. Leveraging trend graphs and weighted average algorithms, the oil field supplier gains unprecedented visibility into 2,000 monthly transactions, enabling it to triple volume output.

W Energy Software provides the company with a complete real time fleet optimization and invoicing solution that includes an advanced mobile app for dedicated use on tablets and printing integration with mobile printers, enabling it to track inventory and generate current customer processing, dispatching and delivery insights. The solution enables dispatch to better optimize fleet performance by seeing if drivers are over or underutilized and, in some cases, allows drivers to completely bypass dispatch by using a “pickup from” or “deliver to” the nearest location feature. The mobile app also leverages real time route optimization capabilities similar to FedEx and UPS to provide drivers with the fastest routes based on current road conditions, taking into account HAZMAT restrictions, if applicable, such as traffic and road closures.

The W Energy Software TMS solution provides actionable insights that help the company mitigate monetary loss by better understanding risks in the field, including complex frac fueling operations, maximizing margins. The solution automatically captures performance history for trucks and drivers (e.g., speeding, running stop signs) and streamlines medical certification compliance with DOT. In addition, W Energy Software’s TMS solution automatically creates physical position reports to help the oil field supplier better manage risks.

By deploying W Energy Software’s TMS solution, the company’s accounting team reduced invoicing time to a maximum of four days, with 90 percent of customer invoices being submitted within one day, while giving it the assurance that it has invoiced 100 percent of its accounts receivable. The solution also helps the oil field supplier avoid millions in sales tax reporting (from a well-known ETRM tax software package) with W Energy Software’s all-inclusive tax module that cut tax preparation for the company from three months to thirty minutes. The solution has had a significant positive impact on its cash flow, enabling the company to purchase more finished fuels and refined products, increase sales and remain positioned for growth.

Best-in-class energy traders are defined by their margins, customer experience and agility to meet evolving market conditions head on. Increasingly, best-in-class risk management in the oil field must incorporate environmental stewardship – not just financial and regulatory risk mitigation – especially as Wall Street, private equity and the public look beyond the wellhead into the broader energy supply chain for ESG improvement. Energy traders, bulk commodity transportation providers, crude first purchasers and other oil field players who rely on large scale trucking operations have an opportunity to embrace digital transformation, enabling organizations to grow revenue and improve customer experience while reducing their carbon footprint and maintaining a social license to operate.

Jeff O’Block has an extensive background in energy accounting and transportation. He is the founder of Chorus Logistics, the leading provider of cloud-based and mobile transportation management solutions (a W Energy Software company). O’Block co-founded Confirmation Corporation, (acquired by the New York Mercantile Exchange in 2002), a developer of software that provides confirmation services to subscribed trading companies. He is co-founder of Texas Cedar Clearing, which has become a premiere oil services company in Texas specializing in seismic line clearing, road building, transportation, site preparation and cleanup, pipeline construction and right-of-way work. O’Block was also the co-founder of PSC Energy, the original developer of GMS, one of the most successful energy trading platforms that became a very popular trade capture, scheduling, and accounting system (acquired by Altra Energy in 2000 and now supported by Sungard). He has assisted pipeline companies in authoring tariffs and is an expert in pipeline operations. O’Block is also a pilot with more than 3,000 hours of flight time.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.