As an upstream player in the oil and gas industry, it is common to conduct a full review of the previous year’s activities and review how various market forces and policies affected the company. As a privately held exploration and production firm, U.S. Energy engages in a thorough strategic planning process prior to committing to actionable initiatives. With the benefit of hindsight, this guest article provides a perspective on the valuable lessons that one upstream energy company learned in 2022.

Global Supply Chain Issues Remain Challenging

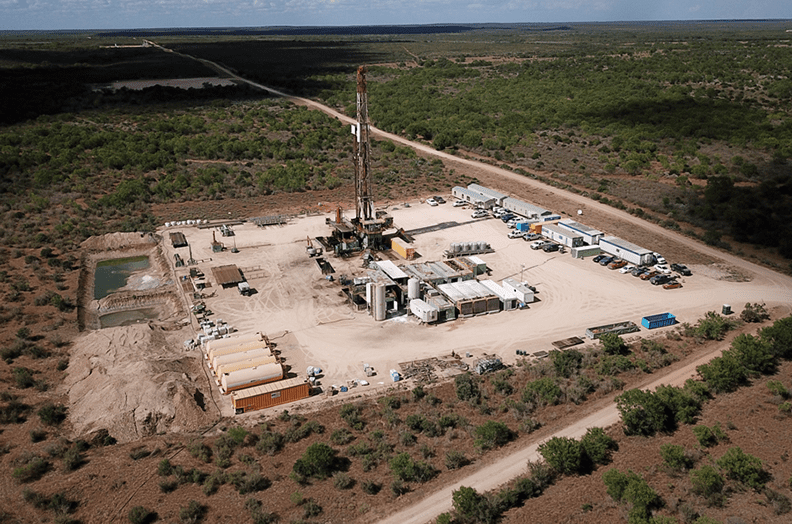

Far and away, the biggest and most pressing challenge for many upstream oil and gas companies continues to be global supply chain issues. In one sense, we were fortunate that commodity prices remained favorable for development throughout the year, yet securing the necessary raw materials and rigs needed to conduct exploration and production was extremely difficult – and pricey. In particular, both steel and sand witnessed major price hikes year-over-year. Materials shortages due to supply chain woes and the subsequent cost overruns caused significant drilling delays for operators.

The industry’s shared supply chain challenges emphasized the importance of consistently analyzing the global market. As many upstream players are well aware, upfront capital costs to drill and complete are crucial to project economics. And variations in cost projections, from original AFE creation date to well spud date, can obviously be significant. Nonetheless, despite the global headwinds, we’re proud of our results in completing several high-graded projects in large tract areas which generated quality results for our stakeholders.

Smart Goals and ESG – A Balancing Act

Establishing sound ESG policies continues to be a priority for upstream energy companies. Many have steadily increased the commitment level and deployment of resources to capitalize on energy transition efforts. U.S. Energy, in particular, focused on securing land acquisitions for solar development, increased our focus on evaluating natural gas projects as a transition fuel, and allocated additional internal resources for renewable project evaluations. We also successfully achieved our primary fiscal ESG goal – to eliminate routine flaring on all operated project sites.

Like many other oil and gas operators, a great deal of attention and focus went into minimizing carbon footprints and investing in the transition to cleaner energy sources. In our case, this was primarily driven by an expansion of natural gas projects, widening our project pipeline to include more renewable opportunities, and setting internal ESG focused goals and policies. While we believe traditional oil and gas will maintain their significant role in the global energy supply for decades to come, we’re actively pursuing opportunities that balance our own strategy for traditional versus renewables.

What We Got Right

Our most successful investment initiative in the past year was our ability to invest in assets with a high confidence in the type curves and working with experienced operators who have the know-how to operate at or below projected costs. When it comes to upstream investment economics, these are the two leading operational risks. Getting them right allowed us to provide key stakeholders with a clear and accurate accounting of project economics throughout the year.

Grading Our Performance

Retrospectively speaking, 2022 was a successful year in which we met or exceeded our annual expectations, both internally and externally. As an upstream oil and gas company that blends both operational and financially innovative strategies, we rarely, if ever, deviate from our core objectives. This nuanced approach has allowed us to scale our growth proportionally. But, as we know, time waits for no man. And once again, with 2023 just around the corner, it’s time to begin the annual strategic planning process all over again.

Jordan Jayson serves as the chairman of the board and CEO of U.S. Energy Development Corporation, determining both the vision and strategy of the firm, as well as the implementation of all change management. Under Jayson’s leadership, U.S. Energy has invested in, operated and/or drilled approximately 4,000 wells in 13 states and Canada, and deployed more than $2 billion on behalf of its partners.

Robert Thaxton is a senior strategist at U.S. Energy Development Corporation. In his role with the company, Thaxton is responsible for planning and execution of various engineering, project management and corporate strategies.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.