The hydrocarbon industry has been a target of attack in the last three decades due to the increased concern over carbon emissions and other pollutants, and more than once the business has been buried when the market declines.

There had never been such a great impact on the industry as was seen in April 2020 when, in part, because of the effects of the pandemic, the price of a barrel fell to unimagined levels. Because there was not a substantial demand for oil, investors were left without space to continue storing product; therefore, they had to pay for this crude to be stored. During that short period of time, there was even talk of a total disappearance of the industry.

Despite differing opinions, with the availability of the coronavirus vaccine, the industry gained a second wind and the price of oil went from $-37 to $75 to $79 per barrel (values which remained constant for the month of September 2021). Although upstream investments have not returned to what they were before the pandemic, gradually many companies around the world have returned to normal operations.

Main Threats of the Oil and Gas Industry

According to the Investopedia portal, the biggest risks for the future of the oil industry for the future are focused on five main areas:

- Political risk: Different factors are taken into account, with one of them being the different regulations for the operation of a field. For example, in most cases, government entities have the full right to allow or refuse the exploitation of a field.

- On the other hand, the bureaucracy in some countries, such as Latin America, delays the processes. Critical decisions, such as the change of mud or even the change of casing diameter, must be reported and allowed by the corresponding entity, thus generating unproductive times and increasing costs for operating companies. This type of threat depends on the government and international relations.

- Geological risk: Conventional and unconventional deposits come into play in this region. Conventional ones are those of easy operation, with shallow deposits and few structural geological problems. This type has been located and is almost depleted in many areas worldwide, which leaves only unconventional deposits as an option. These are characterized by complicated locations, with extreme working conditions, and large investments are necessary in order to have a worthwhile return over time.

- Unconventional deposits are one of the biggest challenges in the industry for reasons such as investment in technology to facilitate the location. Extraction was on the rise, but at a time when the price of oil is falling, these types of projects are stopped and completion times are increased. There is no doubt that the operation of these fields compromises investment and, therefore, compromises the future of production.

- Price risk: The investment that can be made toward a field goes hand in hand with the price of the barrel at the moment; therefore, the risk of loss is always latent. At the same time, the investment depends on the difficulty of operating the field. The reservoirs with the greatest number of structural problems are the unconventional ones, reaching depths greater than 20,000 feet; surely the investment will be greater and the return time will increase.

- Despite this, the companies that invest in these projects dedicate their efforts to find ways to lower costs and increase profitability and safety in unconventional fields. On the other hand, they tend to try to predict the price of a barrel over time to validate whether an investment in a certain deposit is viable over time.

- Supply and demand risks: Supply and demand are the pillars that govern the price of a barrel of oil and, at the same time, most of the processes related to the oil industry. The market varies based on supply and demand requirements. When the market has high variation, it is difficult to establish a starting point for a new project; therefore, the best moment is when there is equilibrium.

- This was one of the factors that affected the value of the barrel in times of the pandemic. The demand values fell sharply and, in turn, the price of the barrel, as there was a constant supply in the market while demand continued to decline. After the arrival of the coronavirus vaccine, the demand began to escalate again, giving a break to the companies that withstood the storm.

- Cost risk: Last in the chain, cost risks are the most impactful. As the costs depend directly on each of the variables above, it is also possible they can increase over time. The risk is always present that the profitable economic term can be lost.

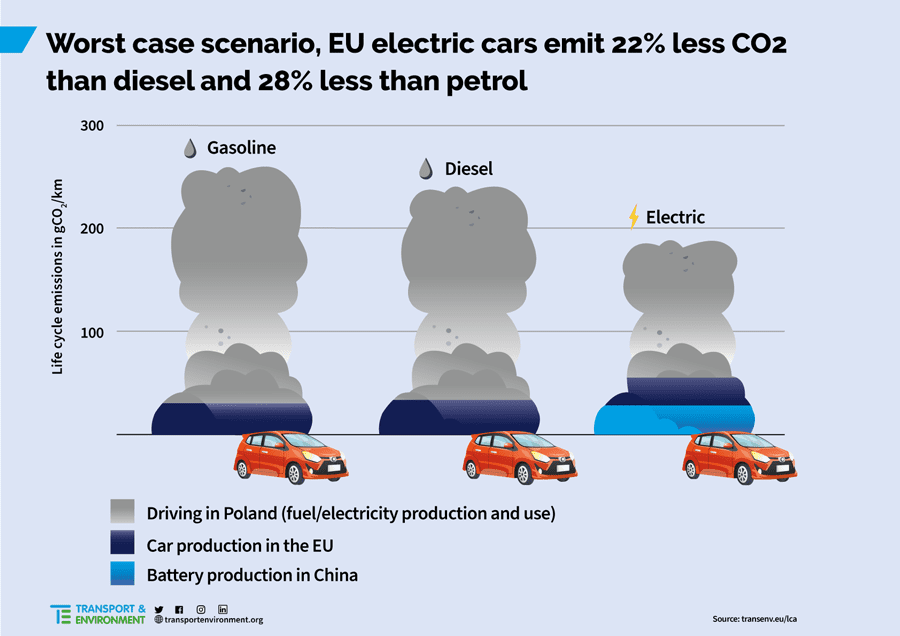

In addition to these five risks, the industry faces a competitor that promises to become more formidable over time: alternative energy companies. Among the fiercest competitors is that of electrical energy to power automobiles. There are positive options offered by this type of vehicle, with one of the biggest being the lack of emissions into the environment.

Why Does the Oil and Gas Industry Have a Promising Future?

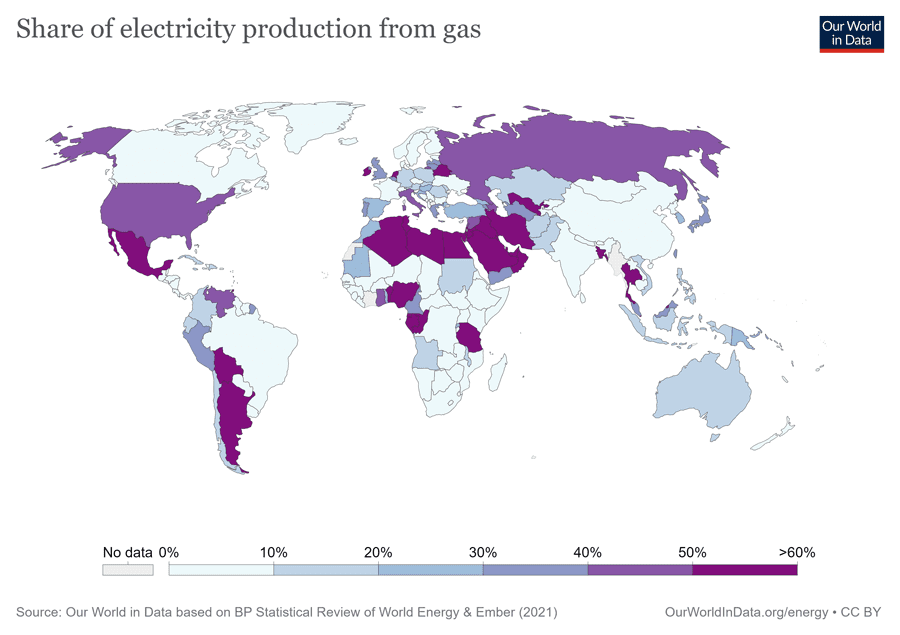

Despite the constant birth and development worldwide of alternative technologies for energy production, the responsibility for keeping the great powers energized remains with the oil industry. Our Word in Data indicates that more than 70 percent of countries use oil as a source of electricity production, and more than 40 percent among them, such as the USA, Russia and China, depend on more than 50 percent of fossil fuels for their electricity production (this analysis is carried out until 2020).

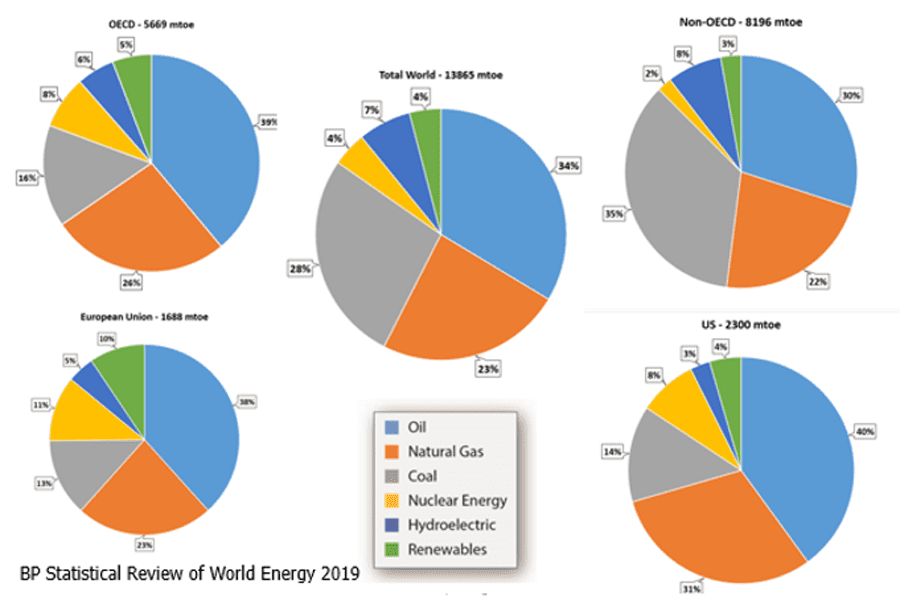

Based on data like this, and the fact that more than 84 percent of the world’s countries depend on natural gas to keep their economies moving, OPEC analysts assure that the demand for hydrocarbons will continue to grow until the middle of the century, then will begin a slow decline due to renewable energy sources. Despite this change, fossil fuels will continue to be the most important part of the world energy mix.

On the other hand, there is the alliance that different companies in the oil and gas industry are making. One of the most important expenses is the acquisition of data in order to be able to operate the fields correctly. For decades, this type of information has been jealously protected by the capturing industries. However, at the end of 2017, SAP and Accenture formed a consortium in which a significant number of companies, including Shell, Chevron, bp, ConocoPhillips, Apache, Devon and Equinor, participate, highlighting the importance of this type of alliance lowering operating costs over time and allowing companies to improve their working times, as well as minimizing risks.

Another argument, in order for the oil and gas industry to preserve a successful future, is the inclusion of new emerging economic activities, such as carbon capture, which will ensure growth of trillions of dollars through the year 2030. Additionally, the biggest source of fossil fuels in the world is coal producers. At the same time, the storage space for the captured coal is expected to be depleted.

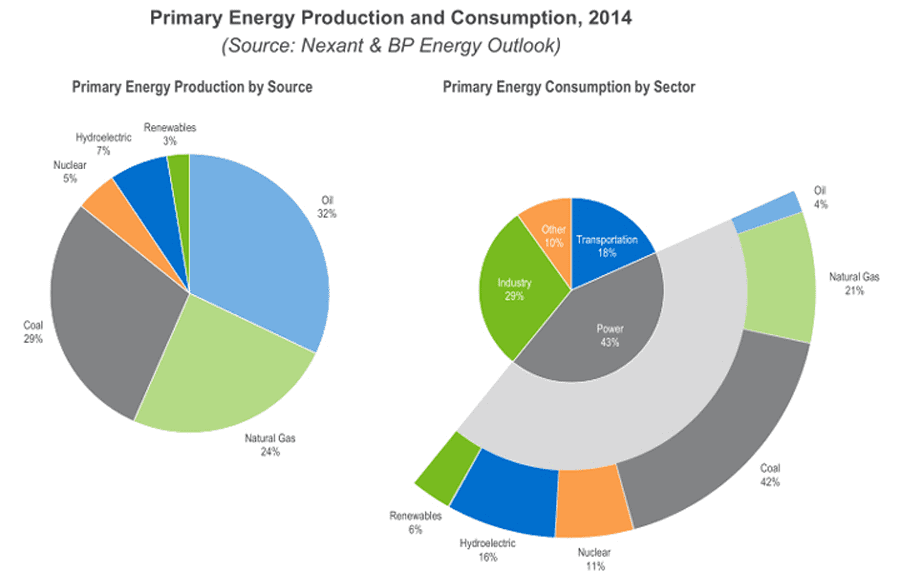

The analyses carried out by PetroSkills for 2019 and Altenergymag for 2014 show that the world’s dependence on fossil fuels for energy has been maintained in the last half decade, despite being the moment when more alternative energies have been born. That birth is one thing, but the investment necessary to change the world is another, thus ensuring the preservation of the life of the oil and gas industry for at least another 50 years.

Headline photo courtesy of Adobe Stock.

Raul Palencia is an engineer and researcher with more than 10 years of experience as a geologist. He graduated from the prestigious University of Andes (ULA), later he received a master’s degree in reservoir engineering at the Venezuela Hydrocarbons University. During his career development, he worked for oil companies in positions such as: field geologist, reservoir engineer and reservoir simulation. He has worked in Argentina, Ecuador, Mexico and Venezuela. He currently resides in Texas.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.

1 comment

Comments are closed.