After experiencing a historic drop in demand during the early days of the COVID-19 pandemic, the U.S. oil market has rebounded strongly due to a worldwide recovery in demand that has outpaced initial expectations. West Texas Intermediate (WTI) and Brent crude oil prices reached $80+/bbl in late Q3 2021 for the first time since 2014, while international demand has recovered to approximately 99.3mm bbls/d, just 2.4 percent lower than the December 2019 level of 101.7mm bbls/d. Barring further widespread shutdowns and travel restrictions, oil demand is expected to resume its pre-COVID growth trajectory in 2022.

As of late Q4 2021, key international producers are yet to announce material production increases. Coupling this news with reduced demand uncertainty has resulted in sustained, elevated oil prices and bullish 2022 profitability expectations for domestic producers and oil and gas service companies. These market conditions also present favorable opportunities for oil and gas services businesses that successfully weathered the pandemic to gain further market share through heightened mergers and acquisitions (M&A) activity.

Mirroring historical periods of market turbulence, 2020 saw a reduction in new exploration and production (E&P) investment and M&A activity across the board as both large and small players raced to downsize operations in response to the oil price crash and uncertain short-term demand outlook. While the energy market recovery has progressed at an accelerated pace in 2021, year-to-date M&A transactions through Q3 2021 already total more than $35 billion. In addition, overall U.S. shale expenditure is expected to increase 19.4 percent to $83.4 billion in 2022, according to Rystad Energy, signaling confidence in sustained production growth.

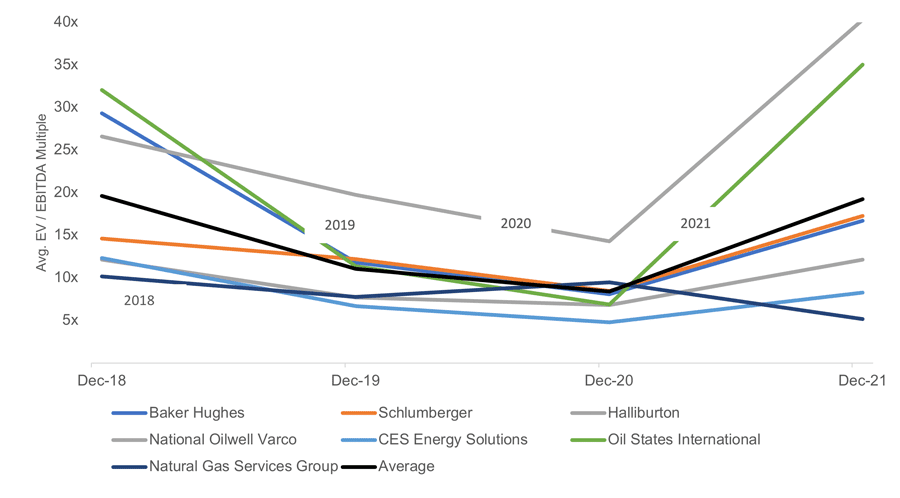

As displayed in Figure 1, leading public U.S. oil and gas service companies are trading at multi-year EV/EBITDA highs as of Q4 2021. Lower average multiples in 2019 and 2020 were driven by a lack of accessible financing leverage and the relative uncertainty of energy prices, highlighted by the multi-year low 8.4x average group multiple in 2020. Due to the improved outlook for international energy demand and confidence in domestic production opportunities heading into 2022, public acquirers will be incentivized to continue pursuing arbitrage opportunities through M&A activity.

When owners seek to sell, spin-off or raise capital, in addition to financial performance, institutional investors typically use select attributes weighted more heavily to determine the valuation and overall attractiveness of an oil and gas services business. Therefore, optimizing and tracking these facets of your company can significantly increase both proceeds and the ability to complete a deal. As riskiness is a key function of value, it is no surprise that these same attributes are among the common differentiators of businesses that emerged from the pandemic in a position of strength. Below are the attributes we see commonly assessed that drive enterprise value by making companies less risky, revenues more predictable and operations more profitable:

- Market Segment Focus – Across the oil and gas services landscape, businesses with less correlation to rig count and new drilling activity are viewed more favorably than those tied directly to production and drilling activity. Therefore, service businesses in the midstream and downstream sectors have historically received higher EBITDA multiples on average than businesses operating in the upstream segment due to less dependence on short-term market conditions.

- Project/Sales Backlog – Having a months-long backlog of booked orders provides predictability of future months’ revenue streams and short-term protection from market downturns while the backlog is worked through. Backlogs create foreseeable, tangible paths to profit that provide investors with confidence.

- Customer Concentration – All things equal, the more diversified a company’s customer base, the better. Investors prefer businesses to ideally have no more than 20 percent revenue concentration with any one customer and no more than 50 percent concentration among the top ten customers.

- Contract Terms – Businesses with long customer tenures, guaranteed contracts and reoccurring or exclusive service relationships are generally viewed more favorably than project-based businesses. Additionally, vendor contracts can have a significant impact on value and attractiveness to investors, particularly for lower middle market companies with exclusive relationships in an attractive geographic region.

- Capital Expenditures – Investors evaluate capex in two buckets – maintenance versus growth capex. Particularly for private equity groups focused on ROI, companies with less maintenance capex are preferred as this represents their most efficient use of capital. On the other hand, successful growth capex strategies that drive revenue growth provide investors with confidence in the company’s future strategy.

- Management Team – While the management needs and integration strategies of strategic acquirers vary by situation, financial investors seek to back management teams with proven industry experience and longevity with the company, yet also with limited key-man risk. Investors also evaluate what current or future gaps exist in the management team to understand how much additional C-suite salary may be needed going forward.

In addition to navigating ongoing supply chain headwinds induced by the pandemic, perhaps the strongest factor in any service company’s short-term outlook is its ability to recruit and retain its workforce. In our conversations with business owners, industry groups, strategic players and private equity investors, supply chain shortages and labor are the most frequently discussed areas of concern. While some supply chain woes have begun to ease, in line with broader labor market trends, oil and gas businesses are forced to consistently navigate pay rate increases, expectations for more comprehensive benefit packages, and an increasingly transitory workforce. As a result, companies with strong human resource departments and training programs, whether insourced or outsourced, represent a significant differentiator to prospective investors.

Sustained by strong energy prices, a return to pre-pandemic demand levels, and an overall healthy consumer economy, tailwinds are in place for oil and gas businesses to achieve strong profitability and growth in 2022. In addition, a full post-lockdown year of strong financial performance coupled with sizable backlogs and increased new drilling activity has led to renewed optimism and confidence from banks and other lending sources. These factors will continue to drive business owners and investors to capitalize on M&A strategies in 2022, leading to increased deal-making across the capital spectrum. Despite energy market setbacks caused by COVID-19, in the absence of future lockdowns or drastic legislative changes, the oil and gas landscape remains a long and profitable runway for well-positioned service business.

John Sinders is a managing director at Founders Advisors investment bank, and is based out of the firm’s Houston office. An experienced industry professional with over 30 years in energy investment banking and private equity, Sinders has also served as a senior executive officer in a major oil service company and as a board member of the Shaw Group after it went public in 1993. Prior to Founders, Sinders led the energy practices at Howard Weil, Jefferies and RBC. Founders Advisors serves middle market companies across six practice areas, including energy. It is headquartered in Birmingham, AL, with a third office in Dallas. To provide securities-related services discussed herein, certain principals of Founders Advisors are licensed with Founders M&A Advisory, LLC, member of FINRA & SiPC. Founders M&A Advisory is a wholly owned subsidiary of Founders Advisors. Neither Founders M&A Advisory nor Founders Advisors provide investment advice.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.