All modern companies aim to obtain new technologies. Intellectual property (IP) can provide significant extra value in the acquisition process, even if you do not intend to own IP. Let’s have a look at the potential, the classical and modern approaches to evaluating acquisition projects and the value of considering IP.

Potential for Increasing Efficiency

The technologies that companies aim to obtain can be divided into two categories: product technologies (embedded into the product) and production technologies (technologies used for the manufacturing process).

Production technologies have the most potential for increasing efficiency through IP rights because of two reasons:

- In the companies that manufacture standard goods such as fuel, basic chemicals, and construction materials, products themselves do not contain intellectual property. As a result, in these types of companies, the production technologies and related IP rights become the most sensitive and valuable consideration for the business.

- Meanwhile, the companies producing innovative goods, such as IT products, electronics, and machines, often focus on managing IP regarding the product technologies but pay less attention to IP in the production technologies. These companies also have the great potential to increase their efficiency in the acquisition of new production technologies.

For all types of companies considering the value of IP in the process of acquiring a new technology offers:

- An additional economic effect including positive cash flows;

- A more accurate project prioritization within a limited budget.

How can these benefits be achieved? The best way to find the answer is to compare classic and modern approaches to evaluating in the process of starting new projects.

Process of Starting Projects

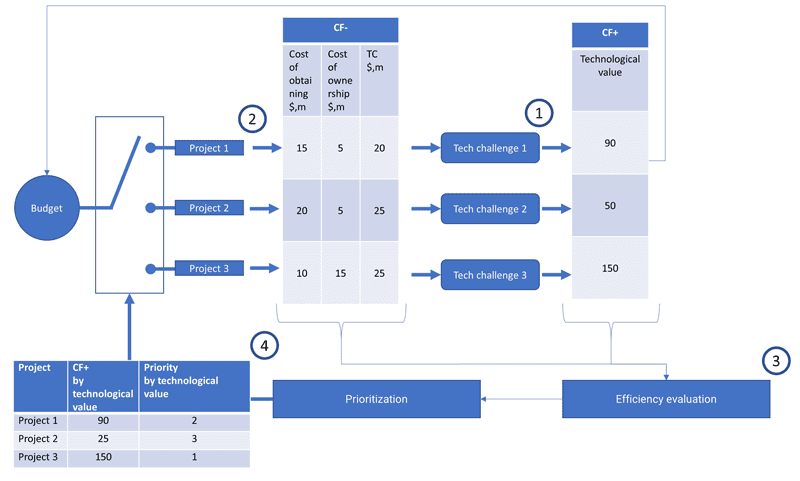

Usually, the process of starting new technological projects includes the following main procedures (see Figure 1):

- Defining technology challenges;

- Formulating projects to solve these challenges;

- Evaluating the efficiency of suggested projects;

- Prioritizing projects and deciding which project to start within the limited budget.

Considering value, the key stage of this process is efficiency evaluation. Each company has its own approaches, methods and standards for this process. Companies often use such dynamic methods as net per value (NPV) or internal rate of return (IRR) to evaluate efficiency. However, the most important step when implementing any method is to set up a correct list of positive and negative cash flows reflecting the economic effect of gaining a new technology. More comprehensive lists produce more accurate evaluations. The list of cash flows must be based on the discovered value of the acquisition. The following sections examine three sample projects through the classical and modern approaches.

Classical Approach to Setting Up the List of Cash Flows

Imagine that the hypothetical projects shown in the figures 1, 3 are related to an oil and gas company:

Project 1 – Software for modeling and determination of hydraulic fracturing (HF) parameters;

Project 2 – Method of heavy oil production using supercritical water; and

Project 3 – Method for construction of a new type of multilateral wells (TAML).

A classical approach is based only on the technological value of the acquisition (as shown in Figure 1); in other words, on the value from the exploitation of technology in the manufacturing process.

In this case, the sources for positive cash flows (CF+) in the aforementioned projects could be:

Project 1 – Reduced costs and extra volume of oil production as a result of optimized parameters of hydraulic fracturing.

Project 2 – Extra volume of oil production that could not be extracted in the past because the technology for extracting this type of heavy oil did not exist.

Project 3 – Extra cumulative oil production, which emerges due to the use of the new construction of wells.

The result of the efficiency evaluation and prioritization by the classical approach is shown in the table in Figure 1.

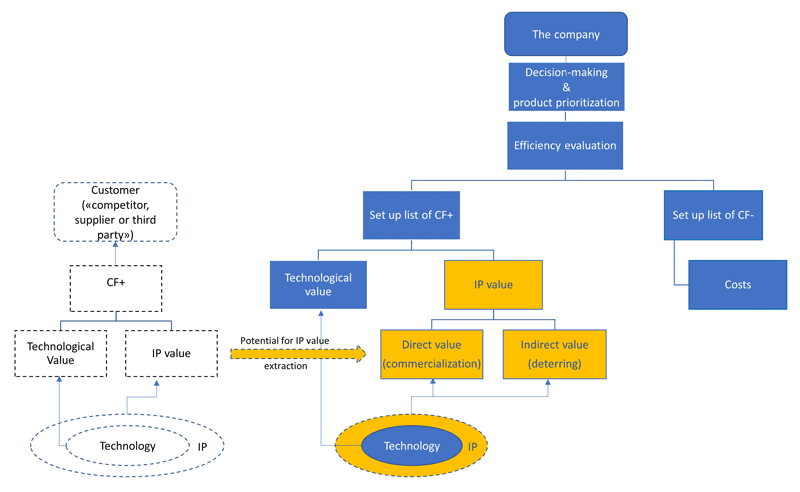

Modern approach to setting up the list of cash flows through discovering the IP value.

In a modern approach, the process of setting up the list of cash flows is more comprehensive. This procedure is based on two sources of value, rather than one (as shown in Figures 2):

- The technological value;

- The IP value, created by acquiring new technology.

Discovering the IP value is a process of developing strategies for extracting value from IP assets. This step must be obligatory for investment in any new technology acquisition to maximize efficiency gains. The procedure of considering IP value is difficult and creative, and it can be performed in different ways.

One of these ways consists of just three steps. The first step is to answer the question, “Does acquiring technology have any technological or IP value for your competitors, suppliers, or third parties?” (see Figure 2).

If the answer is “yes,” one should consider two ways to extract the IP value and try to develop at least one, if not several, strategies by the remaining steps.

The second step is to check direct extracting, promoting competitors, suppliers or third parties to use a new technology and getting direct CF by selling or contributing it (commercialization).

The third step is to check indirect extracting, deterring competitors from using a new technology and getting advantages from it.

Discovering the IP value should be done by a cross-functional team that includes:

- Experts in acquiring technology;

- Commercialization managers;

- Representatives of strategic planning; and

- Experts on IP protection.

Examples of Discovering the IP Value in the Technology Acquisition Process

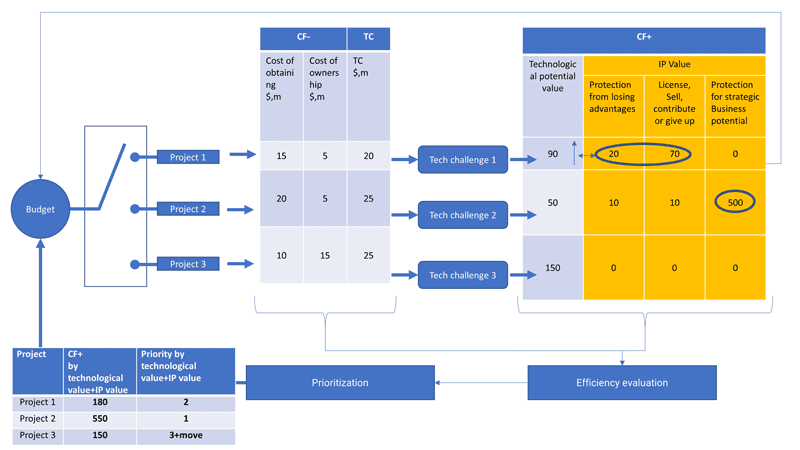

Below are hypothetical examples demonstrating the kinds of IP value that could be discovered and how they could influence prioritization.

Analysis of Project 1, “Software for modeling and determination of hydraulic fracturing (HF) parameters,” shows that acquiring the technology can produce the significant IP value, in addition to the technological value indicated in the section on the classical approach. Moreover, it can be done in direct and indirect ways.

The indirect method of extracting the IP value involves deterring competitors from using the technology. Presence of IP in the project deters competitors from borrowing code and algorithms and forces them to choose between two alternatives: keeping poor efficiency of hydraulic fracturing or spending additional money on developing their own software or on buying software on the market.

In general, the presence of IP in a project offers advantages. If a company does not focus enough on protecting IP or chooses to invest in a project without IP, it cannot deter competitors from borrowing the technology. Additionally, a worse situation can occur: the original company has expenses and a positive economic effect, but a competitor has borrowed the technology with a positive economic effect and no expenses. The result of such investing worsens the company’s position in the market.

By contrast, the direct method of extracting the IP value concerns commercialization. The developing software is in high demand on the market of special software, and a rightsholder may pretend to get the essential part of the market. In this case, there are two options to consider:

- Giving up IP rights to the software developer in exchange for essential reduction of the development price, long-term licenses, and technical support. In this case, value comes in the form of cost reduction, without the intention to own IP.

- Retaining IP rights in order to be the rightsholder and developing a new business for software licensing.

The company should decide what option is to be chosen. According to the business strategy, the company is in the process of digital transformation. The research and development plan includes around 50 projects for developing special software. The company has already decided to establish a new software business for 10 of them and started to create infrastructure for it.

In addition, the rightsholder has two possible synergistic effects:

- The software meets the internal requirements as much as possible.

- Analysis of the exploitation of the software by licensee and their feedback provides new opportunities to improve the quality and efficiency of the software.

This synergistic effect is expected to bring the company extra technological value from exploitation, in addition to cash flows from commercialization. Retention of IP rights seems more profitable.

Could two strategies (deterrence and commercialization) work together? If the use of the technology by a competitor is costly for him and does not affect the original company’s position in the market, then yes. As a result, competitors have four options:

- Keep poor efficiency of hydraulic fracturing;

- Spend additional money on developing their own software;

- Buy software on the market; or

- Buy software from the company.

All four options are satisfactory for the company, and one of them can even turn negative cash flow from a competitor into positive cash flow for this company.

Analysis of Project 2, “Method of heavy oil production using supercritical water,” shows that the project aims to develop a way to extract heavy oil. The new technology is intended to be applied to some license areas that the company already holds.

First, the indirect method of extracting the IP value can be examined. The company includes in its strategic business potential new areas with heavy oil. Licenses for developing these areas are distributed by the government in a competition between rivals. After successful completion of Project 2, the company plans to take part in competition to receive government licenses for new areas with heavy oil.

By this time, exclusive rights (intellectual property) for technology for extracting heavy oil will be owned by the company, making the competition more difficult for other companies. If other companies do not have technology for developing heavy oil, they might withdraw from the competition for government licenses. As a result, the company with the IP will have an increased probability of realizing the strategic business potential of the company and receiving essential extra value in the main business.

Direct extracting of IP value, for example licensing the technology to the competitors, is unwise for this technology because it yields less money than the company could get in the main business by deterring competitors from exploiting the technology.

Analysis of Project 3, “Method for construction of a new type of multilateral wells (TAML),” shows that the project aims to improve the organization of the company’s operations with oilfield service providers. These providers construct multilateral wells according to specification from the company. The results of the project are new requirements for contractor and renovated internal standards. It is most likely that IP in the form of new technological or software solutions will not be created in this project.

Although the project has great technological value, there is no IP value. The company cannot extract additional cash flows from it.

With this factor in mind, perhaps the project should be moved from the investment projects portfolio of new technologies to a portfolio for operational efficiency. In this way, the newly freed money can be used for acquiring new technologies.

Results

Now, both types of value that can arise from acquiring new technology have been discovered, and total cash flow from both types can be evaluated, as is shown in the table in Figure 3.

Project 1 and Project 2 have increased their cash flow and changed their priority. Project 3 has kept its cash flow but lost priority and received recommendation to move to another portfolio.

As can be seen in the illustrative examples, consideration of IP value can bring extra cash flows and change prioritization of projects in the investment process, to the benefit of the company.

If a company acquires new technologies, then it needs to add three components into the process:

- Management awareness of the IP value potential;

- High-level of competency of the IP division; and

- Teamwork aimed to discover the IP value.

Under these conditions, any company can increase its effectiveness in the acquisition of new technologies through IP rights.

Stanislav Aleksandrov currently lives in Istanbul, Turkey, and works as a self-employed counselor. His background as a specialist and a manager on intellectual property includes:

2018 – 2022 – Head of intellectual property department, counselor, GazpromNeft Science and Technology Center;

2018 – IP lawyer, Gazprom 335 Ltd.;

2004 – 2017 – Deputy director for strategic and innovative development. Chief specialist on IP, “Avrora Scientific and Production Association,” marine automation industry.

Aleksandrov graduated as an engineer (red diploma, top degree) on information systems and as a lawyer (red diploma, top degree) at Saint-Petersburg State Marine Technical University, Russia, 2004 – 2005. He is certified as a patent attorney, and received awards and certificates of appreciation from the patent office and professional organizations for protection and management of IP. Throughout his career, Aleksandrov has been involved in writing courses and teaching intellectual property.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.