By now, the majority of mutual fund portfolio managers and investor-class financial planners are aware of opportunity zone investing. It’s a relatively new investment vehicle created by the Tax Cuts and Jobs Act of 2017 and primarily designed to foster economic redevelopment in impoverished areas across approximately 8,700 U.S. census tracts. While the benefits of this investment vehicle might be the greatest financial planning tax tool ever, there are reasons why opportunity zone investing has been slow to catch on – and sometimes difficult to promote beyond traditional real estate and energy plays that rely on raising capital funds to invest.

Before we get to that, let’s review several of the unique benefits to investing in opportunity zones. First and foremost, it offers the best arbitrage in the market, combining competitive rates of return with early cash flow and traditional oil and gas tax benefits. Why is this the key value proposition? Because optimal investments are not judged solely on what you can earn, but also what you can keep. Here’s how it works:

These types of investments are constructed through filings with the IRS (Form 8896) to develop a Qualified Opportunity Fund (QOF), a vehicle organized to invest at least 90 percent of the capital raised in a designated opportunity zone property tract. If investors hold their stake for 10 years, they owe no capital gains tax on the investment until Dec. 31, 2026, potentially creating double-digit increases on annualized returns.

Several factors make opportunity zones an extremely attractive investment for the energy sector in particular, to the benefit of both producers and investors alike. First, the oil and gas market conditions in previous years were experiencing unprecedented headwinds. Volatile pricing, overleveraged debt loads, regulatory issues and other factors led to a severe constriction of capital, resulting in negative cost compression for profitability. However, the introduction of the opportunity zone investment vehicle arrived at just the right time, providing the ability to construct funds in a more cost-efficient manner – often a third less than traditional direct energy funds.

The opportunity zone tracts overlay some of the most prolific oil and gas plays in the U.S. Thus, by adhering to the provisions, the funds are allocated for original use, taking lease of the property tract, and developing exploratory wells with no substantial property improvements required. Provisions such as these allow opportunity zone funds to develop strong cash flow in the early years, without waiting on debt financed distributions commonly seen in other types of development projects. All traditional deductions are still passed through, in addition to the income generated, and the risk can be further mitigated through cross sector matching funds that combine energy and real estate development dollars for a better overall outcome.

Outside of the real estate development and energy sector, the investment community at large has yet to embrace these tax deferral and tax-free advantages. With such a promising investment outlook, how is it possible that the middle market investor audience has so far missed the boat? Primarily because a majority of them still mistakenly believe the 2026 tax deferral is the vehicle’s greatest feature. However, from a benefit standpoint, it’s not the tax deferral alone that is driving the potential of opportunity zone investing; it’s also the tax-free nature of the investment’s full life cycle. The backside of the investment’s returns, with its compounded wealth, is worth much more over time. As an investor, you are only limited to the amount you have in capital gains. This is why the combined tax deferral and tax-free benefits are often compared to an unlimited “Super Roth” IRA.

Applying the adage of full disclosure, it bears mentioning that an unclear understanding of the full benefits of opportunity zone investing from the outset left many retail investors uninterested. A two-year delay in the U.S. Treasury’s clarifications and guidance contributed to a lack of widespread trial and adoption. In addition, uncertainty related to how the current U.S. administration may or may not raise rates for capital gains taxes has also played a factor. These concerns have left many average end investors without the full knowledge of how to employ opportunity zone investments as a tax planning tool, and where they fit in the overall value chain of financial and estate planning.

The good news is there is still time for the investment community at large to take advantage of opportunity zone investing. We are currently in a prime window of opportunity with the two different tax benefits—the deferral, which only goes through 2026, and the tax-free status, which comes to fruition only after holding the investment for 10 years. After maintaining the investment for the required time span, these stakeholders can then sell the investment between the years of 2031 – 2046 and all gains are tax free.

Just as opportunity zone investing came along at the right time for the energy sector, the potential matches nicely with the modern approach of offering investment opportunities based solely on the best risk-adjusted return profile. Successful firms have adopted a more agnostic approach to investment vehicles based on large-scale financial data sets featuring repeatable trends and a tight standard deviation of performance. As a result of this practice, it’s become much easier to structure securities that have the most consistent arbitrage-producing opportunities for investors. It’s highly important for the project profiles of these opportunity zone investments to align with a binary goal in mind, producing both a high amount of economic return on investment and a decent internal rate of return. Applying this measured and focused approach means the outcome of any potential investor’s return will always include the mean regression of performance as a common denominator.

That makes opportunity zones a promising investment strategy – not just for the oil and gas industry – but the middle market investment crowd as well. Let’s hope they take notice.

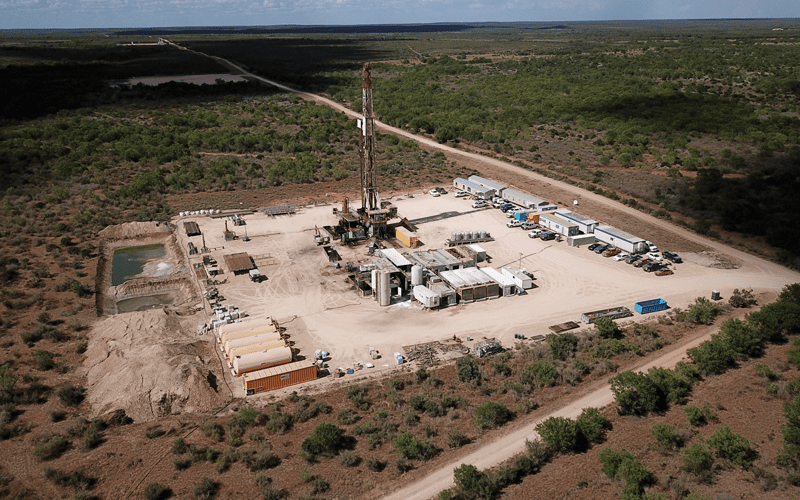

Headline photo courtesy of USEDC. Operations Drill Rig.

Matthew Iak is the executive vice president of U.S. Energy Development Corporation (USEDC) and a member of the company’s Board of Directors. Iak is also the president and CEO of Westmoreland Capital. He has extensive knowledge of private placement, Regulation D, and estate and tax planning strategies. He has pioneered the way for multiple new investment structures in the oil and gas space. Since 2005, Iak has overseen a capital raise of approximately $2.0 billion. He can be reached at miak@usedc.com.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.

1 comment

[…] article for OILMAN Magazine about the value of investing in qualified opportunity zones, (Missed) Opportunity Zones – Why Investors Should Take Note. The submission provided readers with a comprehensive explanation of qualified opportunity zone […]

Comments are closed.