While other industries have adopted software technology to automate and optimize business processes, the oil and gas industry has been slower to respond. The companies that aren’t behind are using software to eliminate waste, identify areas of efficiencies and undertake best practices to better control costs and manage capital expenditures.

In today’s oil and gas economic climate, commodity prices are at record lows, leading to tight budgets with companies reducing their capital expenditures. Managing capital expenditures and budgeting AFEs is only half the battle to controlling costs. It’s no longer a case where companies are setting capital budgets and have AFEs that they’re budgeting for that particular year, they now need to be able to forecast their costs and future spend on projects. We no longer have margins for budget overages.

Forecasting AFE spending is the key to surviving the downturn and managing cash flow, but many companies don’t have the best practices and appropriate technologies in place to manage capital expenditures and forecast costs in this new environment.

Challenges

Some of the challenges companies face when trying to establish cost control and capital management best practices are:

- Capturing field costs and insuring data entry is accurate, detailed and updated weekly. A lot of companies still aren’t tracking their field cost data on a daily basis; or down to the line item. So they’re not able to capture a forecast and track their year-to-date spending against their budget.

- AFE spend must be monitored monthly. It’s no longer a matter of checking end of the year, inception-to-date costs.

- Companies don’t have the tools or processes in place to allow AFE budget managers to monitor current spending and to forecast future spending from initial budget through project completion.

- No process for project completion and closing AFEs, which means they are not able to put costs against the AFE, which leads to a project being over budget.

- Not all CapEx projects are captured in the forecast. They might be capturing drilling and completion, for instance, but not their G&A AFEs or workovers. It’s really important to capture all capital expenditures in the tool they use so they can forecast all their expenditures and future spending.

- No tools or processes in place to reforecast based on level of completion, scheduled updates or cost adjustments.

No process to ensure proper accruals are being made each month, enabling more accurate forecasting of remaining months.

The Solution

The first step to solving these challenges is to clearly define ownership of AFE forecasting, budgeting costs and managing capital projects. This step probably includes three different people in a company, or different business units, so it’s important to define who owns these areas and make sure they’re using one application that lets them do their part while allowing all individuals to contribute.

To do this, you need to adopt one solution for a centralized approach to AFE capital tracking, monitoring and forecasting. Have one solution that lets you budget your AFEs, budget your capital expenditures at the well, asset, and corporation level, and forecast future spending.

This solution should integrate with other key systems for real-time spend analysis. It’s not enough to just have an AFE automated workflow tool; if you’re not integrating with accounting systems or well data management systems, you don’t have access to your real-time spending.

Best Practices

Inception-to-Date Costs

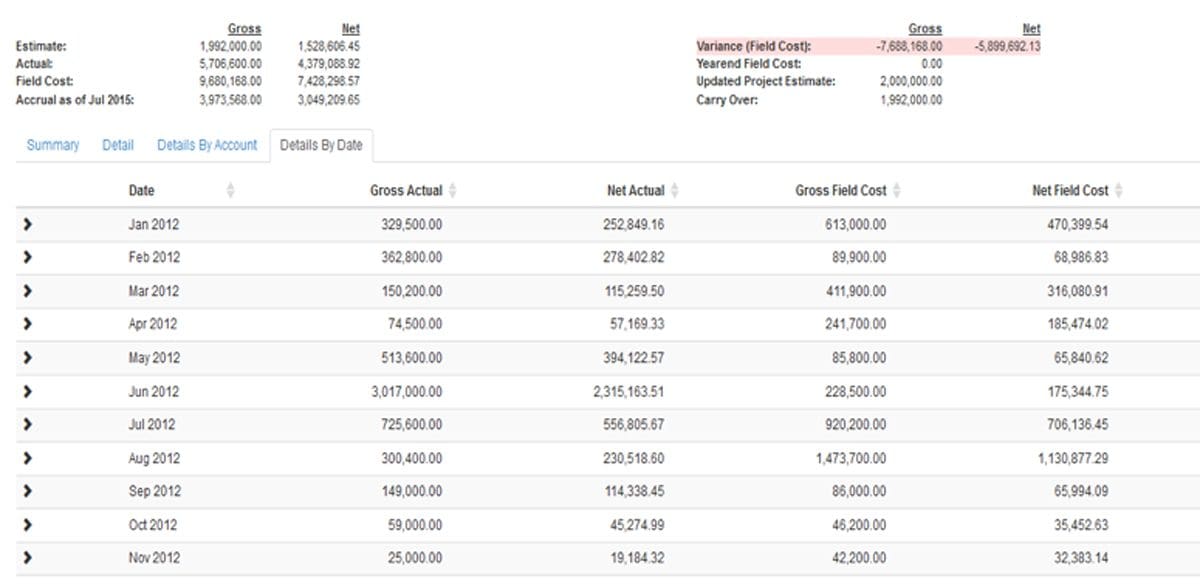

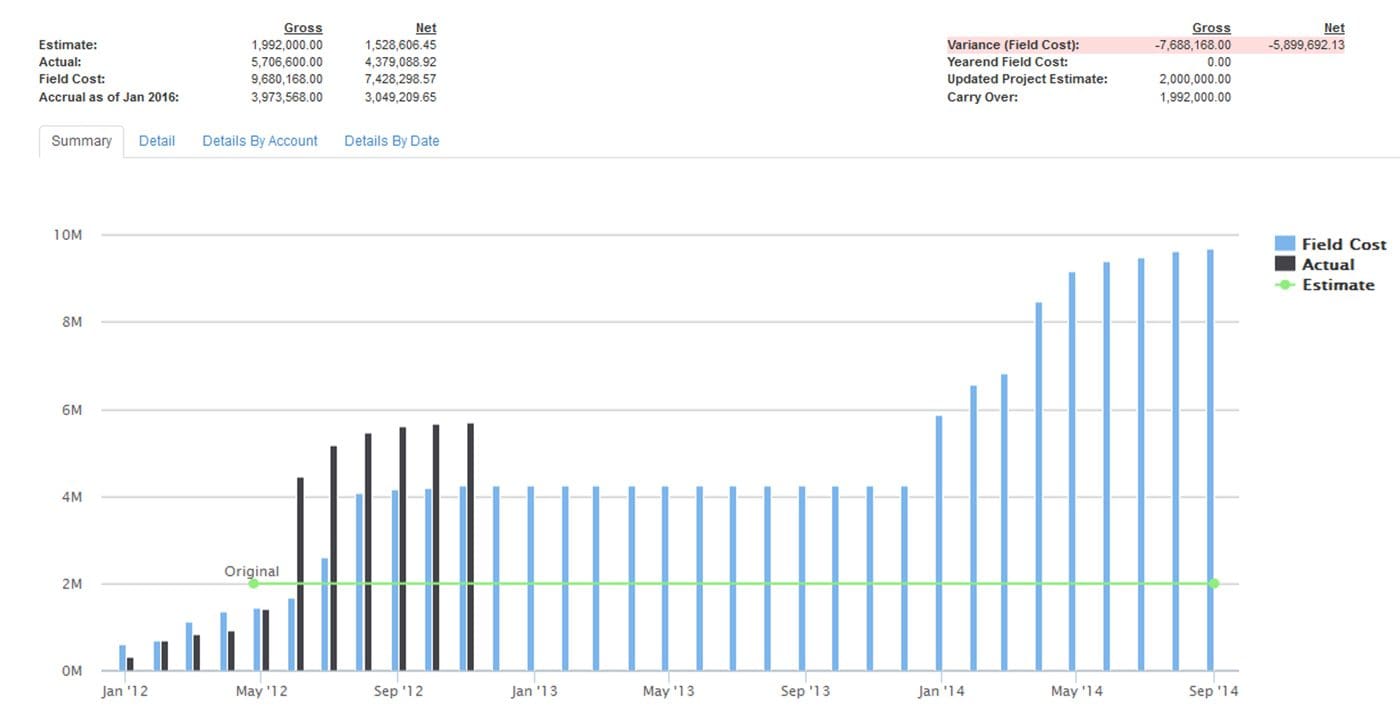

Below you can see an example of inception-to-date costs of a well. Here, you can look at what was budgeted on the AFE and what actual costs you have incurred on a monthly basis vs. field costs.

The ability to look at your overall gross estimate versus actual versus field costs is imperative to be able to manage your capital expenditures at the well level and roll up that information to the corporate level. It’s very important to be able to provide this information to your investors, to your joint venture partners, or potentially with your working interest partners.

Monthly AFE Costs

It used to be that your budget managers were looking at the overall inception-to-date costs on the AFE. Now they really need to monitor the spending on a monthly basis. You can’t be $80,000 over on a well for a particular month, as the margins are too slim. So it’s important to have the tools to monitor AFE spend on a monthly basis in order to identify any overspending by drilling down to a specific line-item, invoice or vendor.

Update AFE Monthly Project Forecasts

As you go through an AFE project, you need to be able to adjust your monthly project forecasts. So whatever the remaining amount is to complete the project, you need to update that and forecast it within the tool you use.

Summary

To summarize:

- Managing capital expenditures and budgeting AFEs is not enough to control costs.

- Forecasting AFE spend monthly is imperative.

- Companies need a process to accurately forecast AFE spending in future months in order to manage cash flow.

- Accurate field data entry and project forecasting is key to preventing budget overruns.

- Improve bottom lines and gain significant competitive advantage, by undertaking best practices and appropriate technologies to manage capital expenditures and forecast costs more accurately.

So if you want to improve your cost control and capital management, ask yourself, do you have the technology in place today to forecast AFE spending, control costs, and manage your capital efficiently? If the answer is no, now might be the ideal time to implement a system that will get you to where you need to be. With margins this tight, you can’t afford not to.

Marsha Vigil is an Account Manager with Energy Navigator and a subject matter expert in AFE workflow best practices, business processes and process improvement. Marsha’s primary focus is helping clients identify and preserve value with less work.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.